Introduction: Why Composable Finance 2025 Matters in 2025

The conversation around composable finance 2025 is growing louder as investors, institutions, and even regulators begin to see how decentralized finance (DeFi) is evolving into something more modular, scalable, and practical. Unlike the early days of DeFi, which felt experimental and fragmented, composable finance aims to integrate different financial tools seamlessly—creating a plug-and-play ecosystem where tokenization and smart contracts reshape how portfolios are built and managed.Think of it as Lego blocks for your portfolio. Instead of relying on a single custodian or broker, investors can now combine tokenized real-world assets, automated smart contracts, yield strategies, and liquidity sources—all on-chain. The result is a flexible, programmable investment experience that adapts in real time.But why does this matter in 2025? Because institutional adoption, regulatory clarity, and the rise of tokenized treasuries, bonds, and other real-world assets are finally converging. Portfolio management is no longer just about stocks, ETFs, and mutual funds—it’s about building a diversified, automated, and composable portfolio on-chain.

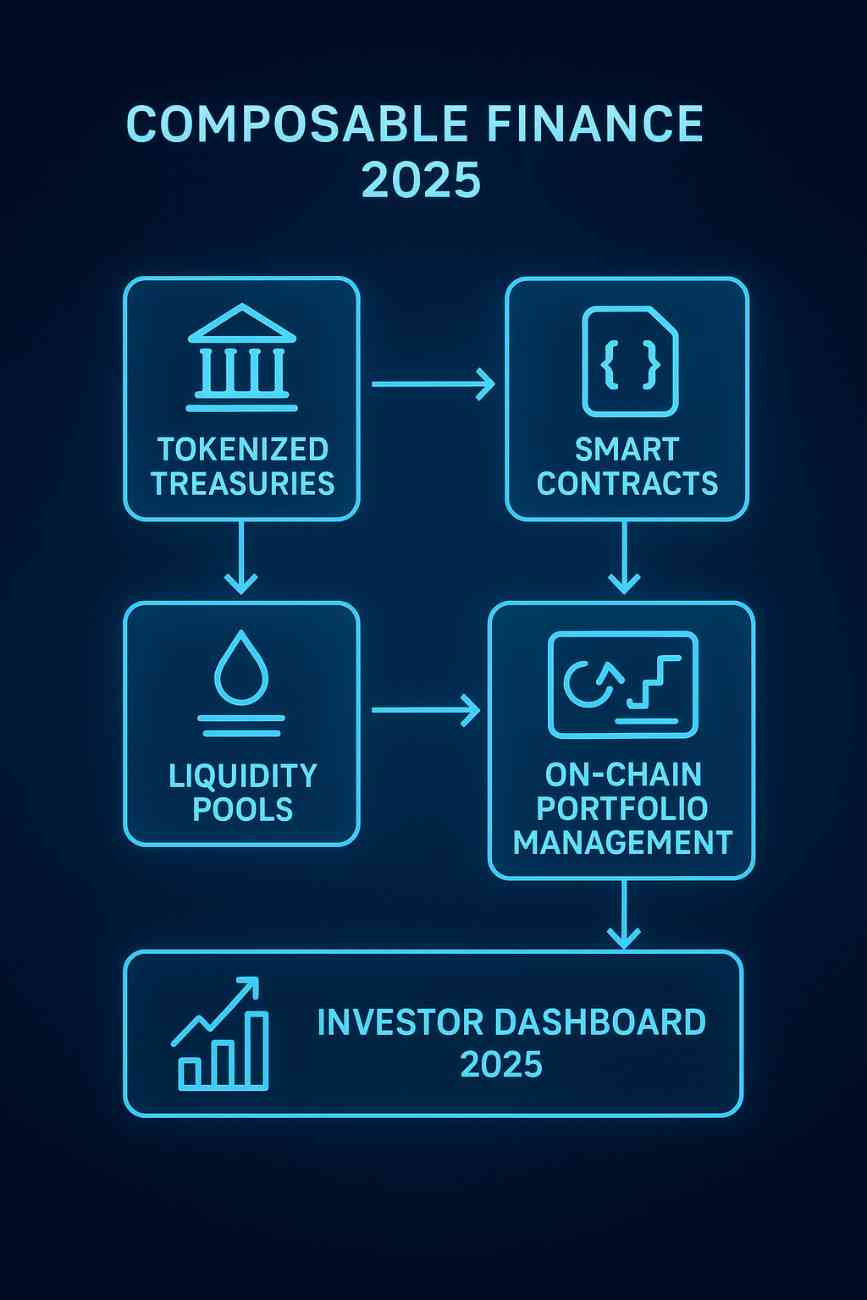

How Composable Finance 2025 Works

At its core, composable finance is about interoperability. Instead of siloed apps or exchanges, DeFi in 2025 runs on a modular framework where different protocols and assets can interact.

This ecosystem relies on three pillars:

Tokenization of real-world assets (RWAs) – bringing bonds, treasuries, real estate, and more into on-chain formats.

Smart contract automation – replacing manual rebalancing, settlement, and yield strategies with self-executing code.

Cross-chain interoperability – ensuring assets and data can flow across Ethereum, Layer 2s, and other blockchains.

Together, these components create an open financial operating system where portfolios are more transparent, cost-efficient, and customizable than ever.

Tokenization of Real-World Assets Composable Finance 2025

One of the biggest drivers of composable finance 2025 is RWA tokenization. Instead of holding U.S. Treasuries through a broker, you could hold tokenized versions directly in your crypto wallet. These tokenized treasuries and bonds are not only more liquid but also programmable—meaning they can integrate with smart contracts for collateral, staking, or automated yield strategies.

This shift unlocks new opportunities. Retail and institutional investors alike can access high-quality, yield-bearing assets without relying on intermediaries. Tokenization also lowers barriers to entry, making traditionally exclusive investments available in smaller, fractional amounts.

“Tokenization is also transforming private credit, as I explained in my [Private Credit 2025]article.”

Smart Contracts & On-Chain Automation in Composable Finance 2025

Smart contracts are the backbone of composable finance. They execute rules without human intervention, reducing friction and cost. For example, instead of manually rebalancing a portfolio, a smart contract can automatically adjust allocations based on market volatility, yield opportunities, or user-defined risk limits.

This level of automation extends to liquidity pools, AMMs, and even restaking strategies. By embedding risk controls and rules into code, investors gain a level of efficiency and trust that traditional systems simply can’t match.

Portfolio Management Use Cases in Composable Finance 2025

The practical applications of composable finance in portfolio management are already here—and they’re only expanding in 2025.

Automated Rebalancing & Risk Controls with Composable Finance 2025

Instead of checking your portfolio weekly, composable finance enables automated rebalancing through programmable assets. For example, if your exposure to Ethereum rises above 40% of your portfolio, smart contracts can sell the excess and reallocate to stablecoins, bonds, or tokenized treasuries.

Risk controls like stop-loss orders or volatility caps can also be coded into your portfolio strategy. This means investors don’t just save time—they reduce emotional decision-making that often hurts returns.

Cross-Chain Liquidity & Interoperability

In 2025, cross-chain interoperability is more than a buzzword—it’s essential. Portfolios no longer exist solely on Ethereum; they span Layer 2s and alternative chains. Composable finance ensures seamless movement of assets, whether you’re chasing yield on a new Layer 2 scaling solution or hedging exposure with tokenized assets elsewhere.

This interoperability reduces fragmentation and improves efficiency, giving investors a broader, more unified investment landscape.

Opportunities for Investors in Composable Finance 2025

Composable finance isn’t just a tech innovation—it’s an investment opportunity. From tokenized government bonds to advanced yield strategies, the ecosystem offers multiple ways to build smarter portfolios.

Access to Tokenized Bonds, T-Bills & Yield

Institutional adoption of tokenized treasuries and bonds is accelerating. For investors, this means direct access to low-risk, yield-bearing assets without relying on banks or brokers. These tokenized versions also integrate into DeFi protocols, allowing investors to use them as collateral, trade them instantly, or layer them into automated yield strategies.

Yield Aggregators, Staking & Restaking

Yield aggregators in composable finance 2025 optimize returns by automatically shifting assets into the best-performing liquidity pools or staking opportunities. Staking derivatives (LSTs) and restaking strategies further expand yield opportunities, allowing investors to compound rewards while maintaining liquidity.

For example, you could hold staked ETH while simultaneously using it as collateral in a yield aggregator—unlocking multiple revenue streams without additional manual effort.

Key Risks and Challenges

While the opportunities are compelling, composable finance 2025 is not without risks.

Smart Contract, Oracle & MEV Risks

Smart contracts may be efficient, but they’re only as good as their code. Bugs, exploits, and vulnerabilities remain real threats. Oracle risk—the reliability of off-chain data feeding into on-chain contracts—also poses challenges. Additionally, MEV (miner/maximal extractable value) risks can erode returns when transaction ordering is manipulated.

Regulation, KYC/AML & Custody Choices

As regulators increase scrutiny, on-chain compliance (KYC/AML) will become standard. Investors will also face decisions between self-custody and custodial wallets. While self-custody offers independence, it also comes with responsibility. Custodial solutions may offer simplicity but at the cost of trust and fees.

Building a Composable Portfolio

If you’re interested in building a portfolio within this new framework, the good news is you don’t need to be a developer.

Tools, Wallets & Security Best Practices

User-friendly wallets with account abstraction are making DeFi more accessible. Security remains paramount: use hardware wallets, enable two-factor authentication, and diversify across trusted protocols. Gas fees optimization tools are also improving, ensuring transactions are efficient and affordable.

Diversification, Stablecoins & Risk Limits

Diversification is still key. In composable finance, that means balancing exposure between tokenized RWAs, yield strategies, stablecoins, and higher-risk assets. Stablecoins continue to serve as a risk anchor, while programmable risk limits ensure portfolios don’t overexpose to volatility.

FAQs

Is composable finance 2025 safe?

Like any financial innovation, there are risks. Smart contract vulnerabilities, regulatory uncertainty, and market volatility remain concerns. However, with proper due diligence and diversification, composable finance offers opportunities for safer, more transparent portfolio management.

How does tokenization improve a portfolio?

Tokenization of real-world assets improves liquidity, accessibility, and efficiency. It allows investors to access traditionally exclusive assets, diversify more easily, and integrate holdings directly into automated, on-chain strategies.

Do I need technical skills to use DeFi?

Not anymore. Wallet providers and modular DeFi platforms have made it easier than ever for non-technical investors to participate. Many tools now feature simple interfaces that abstract away the complexity of blockchain transactions.

Conclusion & Next Steps

Composable finance 2025 represents a turning point in how we think about investing. By combining tokenization, automation, and interoperability, it creates a new era of portfolio management—one that is more flexible, efficient, and accessible than traditional systems.

The next step for investors isn’t to wait, but to explore. Start small, test platforms, and build a strategy that balances innovation with risk management. The future of finance is modular, and those who embrace it early will be better positioned to benefit.

Educational purposes only, not financial advice.

1 thought on “Composable Finance 2025: The Future of Tokenized Portfolios and DeFi”