Introduction: Why Open Finance 2025 & Embedded Finance Matter in 2025

The conversation around open finance 2025 is no longer just a niche fintech trend—it’s becoming a cornerstone of the global financial ecosystem. At the same time, embedded finance is weaving financial tools into everyday platforms, creating seamless experiences for consumers and businesses alike. Together, they’re shaping a world where financial services are not only accessible but also contextual, hyper-personalized, and instantly available. But what exactly do these terms mean, and why should they matter to you in 2025? Let’s dive deeper.

What Is Open Finance 2025?

From Open Banking to Open Finance 2025

Open banking was the first step—allowing consumers to share their banking data securely with third-party providers. Open finance takes it further. Instead of just current accounts, it includes savings, investments, insurance, pensions, and even alternative assets. This expansion enables consumers to see their entire financial life in one place, while giving businesses tools to design more tailored services.

In 2025, open finance isn’t simply about transparency—it’s about control and choice. Consumers decide who gets access to their data, and they benefit from smarter recommendations, competitive offers, and improved financial outcomes.

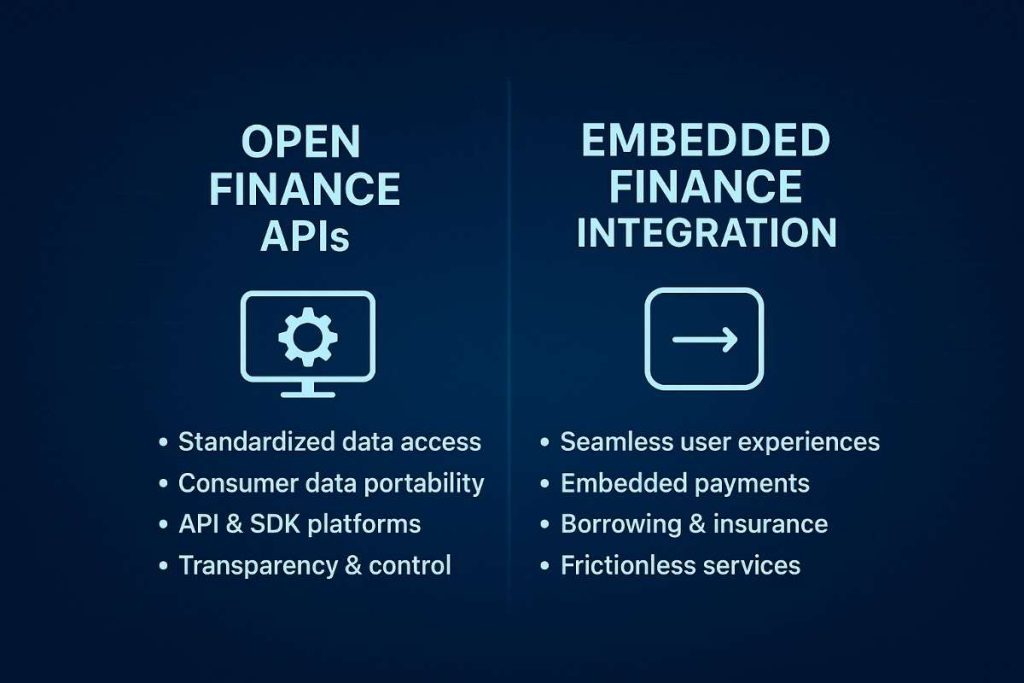

How Open Finance 2025 APIs Enable Secure Data Sharing

The backbone of open finance is the Application Programming Interface (API). APIs act as digital bridges that let financial institutions securely share data with fintechs, apps, and other service providers. Think of it as a plug-and-play model: with APIs, companies can connect and build new products faster.

By 2025, open finance APIs are powering innovations like variable recurring payments, cross-border payments, and real-time account aggregation. Importantly, they’re also evolving to meet stricter compliance standards, ensuring consumer data is safe and traceable.

What Is Embedded Finance 2025?

Everyday Examples: Payments, Lending & Insurance

Using an e-commerce site that integrates payments is an example of embedded finance.

A travel app that offers Buy Now, Pay Later (BNPL) shows how embedded lending works.

Trip protection added at checkout on a booking site is a form of embedded insurance.

The Role of Banking-as-a-Service (BaaS)

None of this would be possible without Banking-as-a-Service (BaaS). BaaS providers supply the regulatory and technological infrastructure—everything from compliance to payments rails—that allows non-banks to offer financial services. APIs and SDKs from BaaS providers let companies “bolt on” finance into their platforms, unlocking new revenue streams and customer stickiness.

Opportunities in Open Finance 2025

Hyper-Personalization & Smart Data Ecosystems

The rise of smart data ecosystems means companies can use AI and analytics to deliver hyper-personalized financial services. For example, an app might automatically adjust your savings plan, suggest tailored insurance, or offer investment opportunities based on real-time spending.

For businesses, personalization is a competitive edge. In 2025, embedded finance paired with open finance data is creating financial experiences that feel frictionless, contextual, and almost invisible—a major shift from traditional banking silos.

Expanding Financial Inclusion Across Markets

One of the most powerful promises of open finance is financial inclusion. In regions where traditional banking infrastructure is limited, open APIs allow fintechs to reach underserved populations. Combined with mobile-first embedded finance solutions, individuals who were once excluded can now access payments, microloans, or insurance.

By 2025, inclusion isn’t just a moral goal—it’s a growth strategy. Businesses tapping into new demographics through embedded services are expanding their customer base significantly.

Risks & Challenges in Open Finance 2025

Data Privacy & Consumer Protection in Open Finance 2025

With great data comes great responsibility. The more financial information is shared, the higher the risk of misuse or breaches. In open finance 2025, data privacy and consumer protection remain top concerns. Regulators are tightening frameworks to ensure that consumers have full control, transparency, and recourse if something goes wrong.

The Connection Between Open Finance and Composable Finance

While open finance and embedded finance are transforming how users access traditional financial services, composable finance is redefining the decentralized side of the ecosystem. By enabling tokenized portfolios and modular DeFi products, composable finance creates flexible building blocks that complement the accessibility of open finance. Together, these trends point toward a future where investors can seamlessly move between traditional and decentralized products. For a deeper exploration of this topic, see our article on [Composable Finance 2025: The Future of Tokenized Portfolios and DeFi].

Regulatory Uncertainty & Compliance for Embedded Finance 2025

Different regions are moving at different speeds. Europe has PSD2 and the upcoming FIDA, Australia has the Consumer Data Right (CDR), while the US is advancing via FDX standards. For businesses, navigating this patchwork of rules is challenging. Compliance requires Regulatory Technology (RegTech) solutions that can adapt quickly to evolving requirements.

Business Impact & Market Growth

Why Fintechs and Big Tech Are Leading the Shift

Fintech startups thrive on agility, while Big Tech companies already control massive user ecosystems. Embedding payments, lending, or investing into their platforms is a natural extension. By leveraging APIs, they can roll out new services at scale with speed.

In 2025, companies like e-commerce giants, ride-hailing platforms, and social media apps are no longer just offering services—they’re becoming financial ecosystems in themselves.

How Traditional Banks Can Compete

Traditional banks still hold the trust advantage, but they risk losing relevance if they don’t adapt. Many are now partnering with fintechs or launching their own embedded finance arms. By embracing platform lending, embedded payments, and cross-border solutions, banks can stay competitive.

The winners will be those that blend security and compliance expertise with the seamless experiences users now expect.

Regional Insights: USA, UK & Canada

Emerging Regulations & Market Readiness

USA: Progress is largely market-driven, with private players setting standards under frameworks like FDX.

UK: Building on open banking leadership, the UK is driving toward full open finance with consumer-first frameworks.

Canada: Still catching up, but policymakers are accelerating efforts to develop a clear open banking and open finance roadmap.

Adoption Trends Among Businesses & Consumers

In North America and the UK, adoption of embedded payments and BNPL has skyrocketed. Businesses view embedded finance as a way to deepen engagement, while consumers enjoy speed and convenience. By 2025, expectations are set: users don’t just want financial tools—they want them built into the platforms they already use daily.

FAQs

Is open finance 2025 safe for consumers?

Yes—when regulated properly. Open finance relies on secure APIs and consumer consent. While risks exist, ongoing regulatory frameworks and RegTech solutions are strengthening safety and transparency.

How does embedded finance benefit everyday users?

It makes financial services invisible yet accessible. Instead of going to a bank or broker, users can get payments, loans, insurance, or investments directly within the platforms they already use—saving time and reducing friction.

What role do APIs play in the future of finance?

APIs are the connective tissue of modern finance. They allow banks, fintechs, and platforms to exchange data securely, enabling open finance ecosystems and powering embedded financial services at scale.

Conclusion & Next Steps

In 2025, the convergence of open finance and embedded finance is redefining how money moves, how services are delivered, and how consumers experience finance in their daily lives. From hyper-personalization to inclusion, from fintech disruption to regulatory evolution, the financial landscape is undergoing a once-in-a-generation shift.

For businesses, the opportunity is clear: embrace these models or risk falling behind. For consumers, the promise is choice, convenience, and greater control.

Disclaimer: Educational purposes only, not financial advice.

1 thought on ““Open Finance and Embedded Finance in 2025: Opportunities, Risks, and Market Outlook””