Introduction Why Green Bonds Matter in 2025

The global push toward sustainability is no longer optional—it’s essential. In 2025, investors view green bonds 2025 not only as an ethical choice but also as a financial instrument directly linked to the powerful megatrend of climate finance. With trillions of dollars flowing into sustainable investing, green bonds are helping investors align profit with purpose while supporting critical climate goals. But how do these bonds work, and why are they becoming such a focal point for portfolios in the USA, UK, and Canada?

Understanding Green Bonds

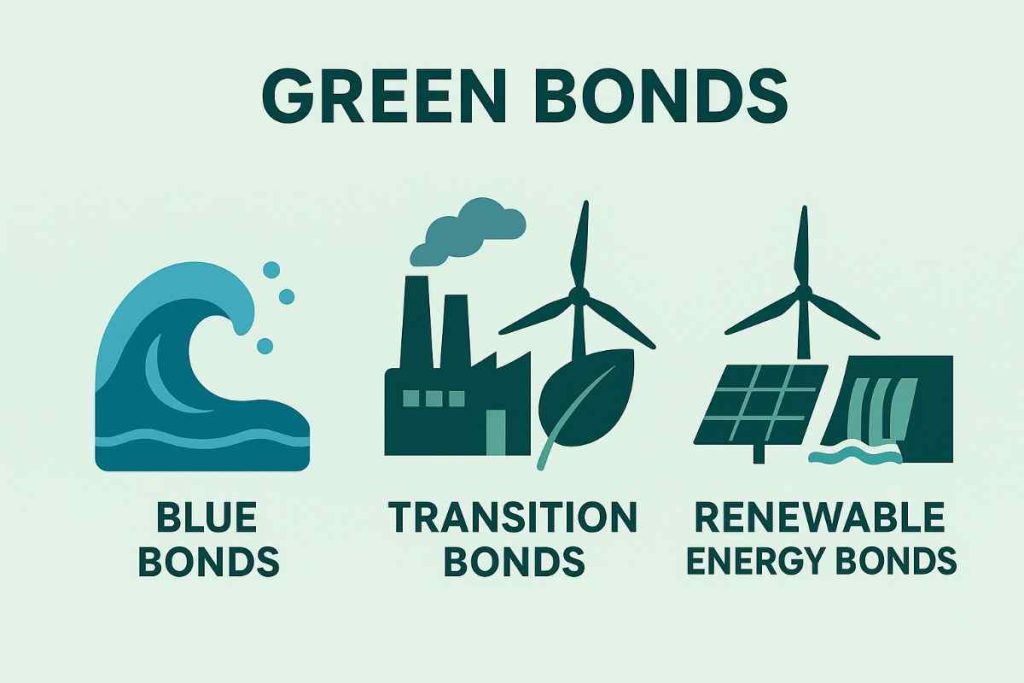

Types of Green Bonds: Blue, Transition, and Renewable Energy

At their core, green bonds are debt instruments used to finance projects that have positive environmental or climate benefits. They are similar to traditional bonds in structure, but the proceeds are earmarked for sustainable projects.

Blue Bonds: Issued to fund ocean-friendly projects like marine conservation, clean water initiatives, and coastal ecosystem protection.

Transition Bonds: Designed for companies moving from high-carbon operations toward lower-carbon models—such as energy firms shifting to renewables.

Renewable Energy Bonds: Focused on financing solar, wind, hydro, and other clean energy infrastructure.

These categories allow investors to tailor their exposure to areas of sustainability they care most about, whether it’s decarbonization, biodiversity, or renewable power.

How Climate Finance Drives Sustainable Investing

Green bonds sit at the intersection of traditional capital markets and climate finance. By channeling private capital into public-good projects, they expand the pool of resources available for climate action. This makes them a critical tool in the broader framework of impact investing and climate-aligned bonds.

Investors are increasingly demanding accountability, and frameworks like ESG reporting and climate risk assessment provide transparency on how capital is being used. In 2025, climate finance isn’t just a trend—it’s a restructuring of how capital markets operate.

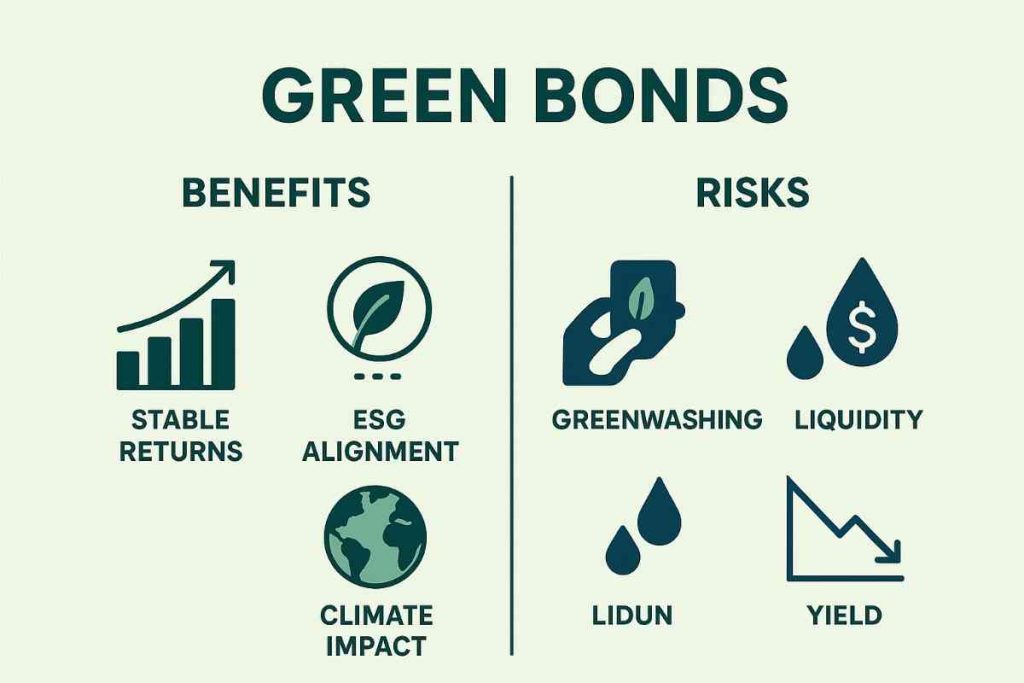

Benefits of Green Bonds for Investors

Risk-Adjusted Returns Compared to Traditional Bonds

One of the biggest myths about green bonds is that they sacrifice returns. In reality, studies show that many ESG bonds perform on par with, or even outperform, their conventional counterparts. Because green bonds are often backed by strong institutions—such as governments, supranationals, or blue-chip corporations—they tend to offer stable, risk-adjusted returns.

Additionally, as demand for sustainable investments grows, green bonds enjoy a “greenium”—a slight pricing advantage reflecting their popularity. For investors, this translates into competitive yields combined with resilience during volatile markets.

Aligning Your Portfolio with ESG Goals

More investors are seeking to align their portfolios with their values. Green bonds make this alignment tangible. By investing in renewable energy bonds, for example, you aren’t just chasing returns—you’re financing wind farms or solar projects that actively reduce emissions.

For institutional investors like pension funds, green bonds help meet sustainability mandates while still delivering predictable cash flows. For individual investors, they provide peace of mind knowing their capital contributes to climate solutions.

Challenges and Risks

Greenwashing and Transparency Concerns

Not every “green” bond is created equal. Some issuers face criticism for overstating environmental impact, a practice known as greenwashing. Without robust standards, it can be difficult to assess whether a project truly delivers climate benefits.

To combat this, investors in 2025 rely on green bond standards, third-party certifications, and clear ESG reporting frameworks. Still, the risk remains that some instruments may fall short of their sustainability claims.

Market Liquidity and Yield Considerations

While the green bond market is expanding rapidly, it still represents a smaller share of global debt markets. This can affect liquidity, particularly for smaller or niche issuances like blue bonds. Investors may also find yields slightly compressed due to the high demand.

However, with rising issuance volumes and increasing regulatory support, these concerns are gradually easing. The growth of green bond ETFs has also improved access and liquidity for retail investors.

The Future of Green Bonds

Regulatory Developments and Green Bond Standards

Regulation is a driving force shaping the green bond market. In 2025, global bodies are pushing for unified standards, making it easier for investors to compare and evaluate bonds. Initiatives like the EU Green Bond Standard and the adoption of climate-aligned taxonomies in the UK and Canada are strengthening market integrity.

These frameworks give investors greater confidence that their money is going where it’s intended—into real climate-positive projects.

The Role of COP30 and Global Climate Initiatives

With COP30 on the horizon, climate finance has taken center stage. Governments and multilateral organizations are leaning heavily on green bonds to meet their commitments under the Paris Agreement. Trillions in climate investment are needed, and green bonds provide a scalable, market-based solution.

For investors, this means a steady pipeline of new opportunities. As nations roll out clean infrastructure, transition financing, and carbon market projects, green bonds will remain the vehicle of choice for mobilizing capital.

How to Invest in Green Bonds

Popular Green Bond ETFs and Funds

For most retail investors, direct participation in bond markets can be challenging. That’s where green bond ETFs and mutual funds come in. These funds pool investor money and allocate it across a diversified portfolio of green bonds, making it easier to gain exposure without selecting individual issuances.

Popular ETFs focus on global green bonds, ESG bonds, or climate-aligned instruments, giving investors flexibility based on risk tolerance and sustainability goals.

What to Look for When Choosing Green Bonds

When evaluating green bonds, consider:

Issuer Credibility: Governments and established corporations often offer more security.

Use of Proceeds: Ensure projects are tied directly to measurable climate benefits.

Certification: Look for third-party validation under recognized green bond standards.

Liquidity: Larger issuances typically offer more robust secondary markets.

By focusing on these factors, investors can avoid greenwashing risks and ensure their capital delivers real impact.

In 2025, the financial landscape is evolving in two powerful directions: sustainability and accessibility. On one side, Green Bonds and Climate Finance 2025 are driving investments toward renewable energy, carbon reduction, and long-term climate impact. On the other, innovations like Open Finance and Embedded Finance are reshaping how investors access, manage, and personalize financial products. Together, these trends highlight how the future of finance is not only digital but also deeply aligned with environmental and social responsibility.

FAQs

Are green bonds safe investments?

Generally, yes. Green bonds carry similar risk profiles to conventional bonds, especially when issued by governments or large corporations. However, like any investment, risks exist and depend on the issuer and project type.

How do green bonds impact climate change?

Green bonds fund projects such as renewable energy, sustainable infrastructure, and carbon reduction. By directing capital into these areas, they accelerate progress toward climate targets and support the transition to a low-carbon economy.

What are the tax benefits of investing in green bonds?

In some jurisdictions, green bonds may come with tax incentives to encourage sustainable investing. These benefits vary by region, so it’s important to review the latest guidelines in your market.

Conclusion & Next Steps

In 2025, green bonds 2025 are not only a tool for sustainable investing but also a strategic opportunity to profit from the global shift toward climate finance. By balancing competitive returns with measurable environmental impact, they allow investors to participate in the sustainability megatrend while supporting critical global goals.

For those ready to take action, the next step is to explore green bond ETFs, assess issuers carefully, and align investments with long-term ESG goals.

Disclaimer: Educational purposes only, not financial advice.

1 thought on “Green Bonds & Climate Finance 2025: Profiting from the Sustainability Megatrend”