Introduction: Why Banking 2.0 2025 & Stablecoins Matter

The financial world is undergoing one of the biggest transformations since the invention of online banking. Banking 2.0 2025 isn’t just about mobile apps or contactless payments—it’s about stablecoins, central bank digital currencies (CBDCs), and tokenized financial systems that promise to reshape how money moves across borders. For businesses, investors, and everyday consumers, this shift could mean faster payments, lower fees, and a reimagined global economy. But it also comes with new risks and regulatory questions that can’t be ignored.

What Is Banking 2.0 2025?

From Traditional Banking to Digital-First Systems

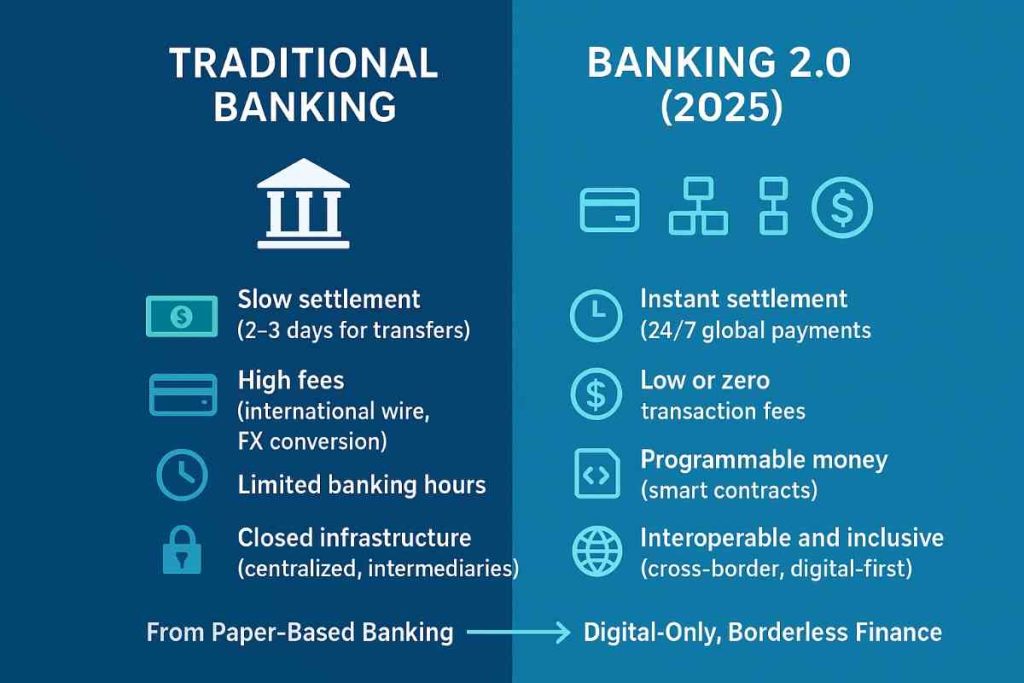

Banking 2.0 2025 represents the evolution from branch-based, paper-heavy institutions to fully digital-first ecosystems. Traditional banks built their systems on decades-old infrastructure that was never designed for instant global transactions. In contrast, Banking 2.0 leverages blockchain, artificial intelligence, and real-time settlement systems to support the always-connected world we live in today.

In the past, consumers had to wait days for a cross-border transfer. Now, however, they can expect near-instant settlement. Furthermore, instead of relying solely on physical banks, financial services are delivered through digital wallets, decentralized platforms, and banking-as-a-service (BaaS) providers that integrate seamlessly with consumer apps.

The Role of Tokenized Payments in Banking 2.0 2025

At the heart of Banking 2.0 2025 lies tokenization—the process of turning money or assets into secure digital tokens. Tokenized payments allow money to move across blockchains with the same ease as sending an email. This makes remittances cheaper, corporate treasury operations more efficient, and global trade more transparent.

Tokenized payments also pave the way for smart contracts in banking, enabling automatic execution of agreements such as loan repayments or supply chain settlements. For businesses, that means fewer intermediaries and lower costs. For consumers, it means greater financial inclusion and faster access to funds.

Stablecoins & CBDCs in Banking 2.0 2025

Cryptocurrencies vs. Stablecoins: Key Differences

Stablecoins are digital currencies pegged to stable assets like the U.S. dollar or the euro. Unlike Bitcoin or Ethereum, which can swing dramatically in value, stablecoins provide consistency making them practical for everyday transactions. They’re increasingly being used for payroll, remittances, and e-commerce.While cryptocurrencies remain popular for investment, stablecoins fill the gap for daily usability. They combine the benefits of blockchain—speed, transparency, and accessibility—with the stability required for global payments.

The Global Push for the Digital Dollar, Euro & Dirham

CBDCs take the stablecoin concept further by being issued directly by central banks. In 2025, we’re seeing real momentum: the U.S. is testing the Digital Dollar, Europe is rolling out the Digital Euro, and the UAE is advancing its Digital Dirham as part of its broader role as a digital finance hub.

These CBDCs aim to strengthen monetary sovereignty while offering the efficiency of blockchain systems. They also align with consumer demand for cashless payments, making Banking 2.0 2025 a mix of private-sector stablecoins and state-backed digital currencies.

Opportunities in Banking 2.0 2025

Faster Cross-Border Payments & Settlements

One of the biggest opportunities lies in global payments. Today, cross-border transactions are slow, costly, and often opaque. With stablecoins and CBDCs, payments between the USA, UK, France, and UAE can happen in seconds, at a fraction of traditional costs.

This efficiency benefits both businesses and consumers. Companies save on transaction fees, while workers sending remittances home keep more of their earnings. The ripple effect could be enormous, fueling global trade and boosting financial inclusion.

Institutional Adoption & DeFi Integration

Institutional adoption of digital assets is accelerating. Banks, hedge funds, and payment giants are now exploring how stablecoins and CBDCs can integrate with decentralized finance (DeFi) protocols. Imagine a world where corporate bonds are issued as tokens, or where trade finance operates through automated smart contracts.

This hybrid model traditional finance (TradFi) meeting decentralized finance creates new opportunities for liquidity, investment, and transparency. And with regulatory frameworks tightening in 2025, institutions are more confident in experimenting with these digital tools.

Risks & Challenges of Banking 2.0 2025

Regulatory Uncertainty & Compliance Pressure

While opportunities abound, Banking 2.0 2025 is not without challenges. Regulations remain fragmented across countries. The U.S. emphasizes consumer protection, Europe focuses on data privacy, and the UAE pushes innovation-friendly frameworks.

For businesses, navigating this patchwork of rules can be costly. Firstly, compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements is becoming stricter. At the same time, regulators are still deciding how stablecoins fit into existing banking laws.

Data Privacy, Security & Systemic Risks

Digital currencies bring new risks around cybersecurity and consumer data privacy. As financial transactions move onto blockchains, questions arise: who controls the data, and how secure are the systems?

Moreover, the widespread adoption of stablecoins or CBDCs could disrupt traditional banks’ funding models. As a result, if consumers hold money directly in central bank wallets, commercial banks may face liquidity shortages, which in turn raises serious systemic risk concerns.

Business Impact & Market Growth in Banking 2.0 2025

Why Fintechs and Big Tech Are Leading the Shift

Fintech startups and Big Tech companies are moving faster than traditional banks. With the rise of Banking-as-a-Service, firms can embed financial products directly into consumer apps. Think of ride-hailing platforms offering instant driver payouts in stablecoins or e-commerce sites settling payments in Digital Euros.

These innovators don’t face the same legacy infrastructure as banks, giving them a competitive edge in speed, design, and scalability. They’re setting consumer expectations for seamless digital finance.

How Traditional Banks Can Stay Competitive

Traditional banks, however, aren’t standing still. Many are partnering with fintechs or building their own digital asset infrastructure. By adopting tokenized payments, integrating smart contracts, and offering custody services for stablecoins and CBDCs, banks can remain central players in Banking 2.0 2025.

Ultimately, the winners will be those institutions that combine trust and regulatory expertise with digital agility.

Regional Insights on Banking 2.0 2025: USA, UK, France & UAE

Emerging Regulations & Market Readiness

In the USA, regulators are cautiously advancing the Digital Dollar while tightening oversight of stablecoins. The UK is positioning itself as a Web3 banking hub, with clear crypto regulation frameworks. France, as part of the EU, is closely aligned with the rollout of the Digital Euro.

To begin with, businesses are experimenting with payroll, supply chain finance, and cross-border settlements using stablecoins. In addition, many companies are testing how tokenized payments can reduce costs and improve transparency across international operations. Furthermore, early adopters are finding that stablecoin-based systems provide faster settlement times, which helps free up working capital and strengthen liquidity. As a result, adoption is now moving well beyond the experimental stage and into real-world implementation. Ultimately, these developments show that Banking 2.0 2025 is not a distant vision but an active transformation taking place across global markets today.

For insights on how tariffs and crypto losses are shaking traditional markets read Global Finance Shock 2025

Meanwhile, the UAE stands out for its proactive stance, promoting Dubai and Abu Dhabi as global digital finance hubs.

These regions highlight different paths toward the same goal: modernizing financial infrastructure for the digital age.

Adoption Trends Among Consumers & Businesses

Consumers in all four regions are warming to digital currencies. In the UAE, crypto adoption is already mainstream, with stablecoins widely used in business transactions. In Europe and the UK, CBDC trials are driving interest. And in the U.S., consumer adoption is rising through fintech apps and stablecoin-based payment systems.

Businesses are also experimenting with payroll, supply chain finance, and cross-border settlements using stablecoins, signaling that adoption is moving beyond the experimental stage.

FAQs on Banking 2.0 2025

Is banking 2.0 2025 safe for consumers?

Yes, but with caveats. Consumers benefit from speed and transparency, but risks like hacking and regulatory changes remain. Choosing licensed, regulated providers is key.

How do stablecoins benefit everyday users?

Stablecoins offer faster payments, lower fees, and easier cross-border transfers. For many, they’re a practical alternative to traditional bank transfers.

What role do CBDCs play in banking 2.0 2025?

CBDCs bring state-backed trust to digital money. They ensure monetary stability while allowing central banks to modernize payment systems for the digital economy.

Conclusion & Next Steps for Banking 2.0 2025

Banking 2.0 2025 is more than a buzzword—it’s the next stage of global finance. With stablecoins, CBDCs, and tokenized payments, money is becoming faster, smarter, and more inclusive. But with innovation comes responsibility. Regulators, banks, fintechs, and consumers must all adapt to balance opportunity with risk.

For individuals and businesses, the key is to stay informed, experiment carefully, and embrace trusted platforms. The transformation has already begun, and those who prepare today will be best positioned to thrive tomorrow.

Educational purposes only, not financial advice.

1 thought on “Banking 2.0 2025 & Stablecoins: How Digital Currencies Are Reshaping Global Finance”