Introduction: Why Gen Z Investors 2025 Matter

The financial world is entering a new era, and much of the momentum comes from Gen Z investors 2025. This digitally native generation, born between the mid-1990s and early 2010s, is reaching adulthood with unique values, tools, and expectations. They aren’t just participating in the markets—they are reshaping them. Unlike earlier generations that eased into investing through traditional brokers, Gen Z is jumping straight into apps, social platforms, and innovative fintech solutions.

What makes them so important? Their numbers are massive, their preferences lean toward sustainability, and their demand for transparency is rewriting how global finance operates. If Millennials disrupted industries with digital-first behavior, Gen Z is doing the same to finance—only faster and with even greater conviction.

Who Are Gen Z Investors in 2025?

At their core, Gen Z investors 2025 are pragmatic risk-takers. They grew up during the Great Recession, saw their parents struggle with debt, and experienced the pandemic’s economic uncertainty. This backdrop shaped a generation that values financial independence yet remains cautious about institutions.

Their average entry point into investing is earlier than Millennials or Gen X. Many start experimenting with digital wallets and savings apps in their teens, then graduate to stocks, ETFs, and crypto before turning 25. The mindset isn’t just about wealth accumulation—it’s about aligning investments with identity, values, and social impact.

From Saving Apps to Neobrokers

The journey often begins with mobile-first saving apps that gamify budgeting. Soon, Gen Z investors 2025 shift toward neobrokers like Robinhood, eToro, or Trade Republic. These platforms offer commission-free trading, sleek interfaces, and fractional investing—perfect for young investors with limited capital.

Unlike past generations who needed thousands to build a portfolio, today’s investors can start with as little as $10. That accessibility has sparked a retail investing boom, creating a culture where nearly every young adult sees investing as attainable.

The Role of Social Finance Apps in Gen Z Investing

Social finance apps take things further by blending community and investing. Instead of learning through textbooks, Gen Z learns through TikTok finance influencers, Reddit forums, and in-app communities. Social trading allows them to follow successful traders, copy strategies, and share insights instantly.

This network-driven model is changing how knowledge spreads. It makes investing more democratic but also introduces risks when hype or misinformation spreads unchecked. For Gen Z, though, finance feels less like a solo journey and more like a collective experience.

Gen Z Investors 2025 & the Rise of Digital Finance

The defining trait of Gen Z investors 2025 is their digital-first mentality. From robo-advisors powered by AI to decentralized finance platforms, they gravitate toward innovation.

Gen Z vs. Millennials: Key Differences in Investing

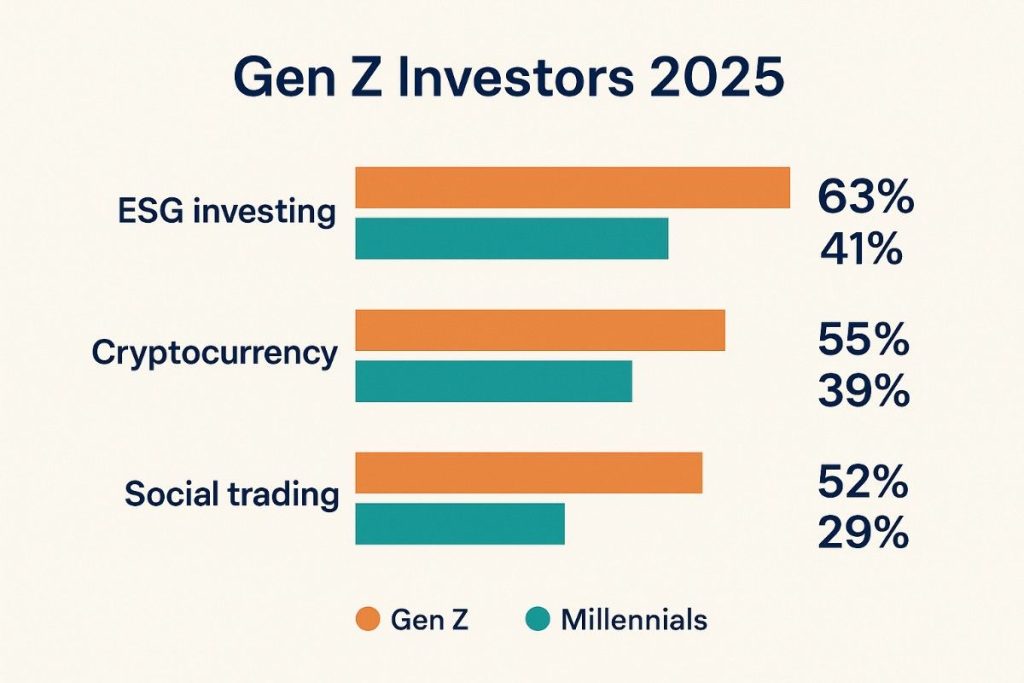

Millennials were pioneers in online banking, but they still relied heavily on traditional brokers and retirement accounts. Gen Z, on the other hand, is bypassing legacy systems altogether. They prefer apps over financial advisors, fractional shares over full stocks, and real-time analytics over quarterly reports.

They also prioritize speed and transparency. Waiting days for a transfer feels unacceptable to a generation raised on instant everything. That urgency has fueled demand for neobrokers and crypto platforms that promise 24/7 accessibility.

The Global Push for Fractional Investing & Social Trading

Fractional investing is no longer a niche feature—it’s a standard expectation. Whether buying a slice of Tesla stock or part of a real estate fund, Gen Z investors 2025 see accessibility as a right.

Meanwhile, social trading platforms are breaking barriers between seasoned investors and beginners. By blending community with commerce, these tools encourage participation while reshaping trust in financial markets. Younger investors often follow peers before institutions, creating a shift in authority.

Opportunities Driven by Gen Z Investors 2025

Wherever Gen Z goes, opportunity follows. Their influence on global finance is forcing innovation across sectors.

Growth of ESG & Sustainable Finance

Sustainability is more than a trend—it’s a non-negotiable demand. Gen Z investors 2025 are fueling the growth of ESG investing, pushing companies to adopt greener policies and transparent reporting.

This generation doesn’t just want profits; they want portfolios aligned with climate goals, diversity, and ethical governance. Their pressure is accelerating the global transition toward sustainable finance 2025. Funds and corporations ignoring these values risk losing both capital and credibility.

Institutional Response & Market Innovation

Institutions are adapting quickly. Asset managers are launching ESG-themed ETFs, while banks are expanding digital wealth services. Even traditional players like BlackRock and Vanguard now court Gen Z with sustainability campaigns and app-first experiences.

The result? A market landscape that feels more competitive, more transparent, and more youth-focused than ever before.

Risks & Challenges Facing Gen Z Investors 2025

While the opportunities are exciting, challenges remain.

Regulatory Oversight & Compliance Pressure

As Gen Z investors 2025 embrace social trading, crypto, and decentralized finance, regulators face mounting pressure. How do you protect investors in a borderless, digital-first system? Governments are scrambling to set new rules around market manipulation, influencer-led advice, and crypto taxation.

The risk is that overregulation could stifle innovation, while underregulation could expose young investors to fraud and bubbles. Striking the right balance is critical.

Data Privacy, Security & Market Risks

Digital-first platforms carry inherent risks. From data breaches to algorithmic errors, the threats facing Gen Z are different from those their parents encountered. Crypto volatility adds another layer, with sharp price swings testing financial resilience.

For young investors with smaller safety nets, losses can have long-lasting impacts. Financial literacy programs and better risk education are becoming urgent priorities.

Business Impact & Market Growth from Gen Z Investors 2025

The ripple effects of Gen Z’s influence are massive.

Why Fintechs and Big Tech Are Leading the Shift

Fintech startups thrive because they understand this generation. They design apps with intuitive UX, instant notifications, and gamified learning. Big Tech companies, too, are entering finance by embedding payment and investing features into platforms Gen Z already uses.

Together, they’re driving an unprecedented acceleration in digital finance adoption.

How Traditional Banks & Wealth Managers Can Stay Competitive

Legacy institutions must evolve or risk irrelevance. Some are partnering with neobrokers, while others are launching digital-first subsidiaries. Wealth managers are introducing hybrid models that blend human expertise with AI robo advisors Gen Z finds appealing.

Those willing to adapt stand to benefit from a trillion-dollar generational wealth transfer. Those who don’t may lose the next generation entirely.

Regional Insights on Gen Z Investors 2025: USA, UK, France & UAE

The rise of Gen Z investors 2025 isn’t limited to one geography—it’s global.

Emerging Regulations & Market Readiness

In the USA, the SEC is tightening oversight of influencer-driven investing. The UK and France are expanding ESG reporting mandates, ensuring companies meet transparency demands. In the UAE, regulators are positioning Dubai and Abu Dhabi as fintech hubs, offering sandboxes that attract global talent.

Discover how stablecoins are driving the next phase of digital finance in Banking 2.0 2025.

Each region balances innovation with investor protection differently, but the momentum toward digital-first investing is universal.

Adoption Trends Among Consumers & Businesses

Adoption varies in speed but not direction. American Gen Z investors are drawn to meme stocks and crypto. British and French investors lean heavily toward ESG. In the UAE, high smartphone penetration drives rapid uptake of digital wealth platforms.

For businesses, the takeaway is clear: adapt offerings to local preferences while keeping pace with global trends.

FAQs on Gen Z Investors 2025

Are Gen Z investors 2025 riskier than older generations?

Yes and no. They experiment more with crypto and meme stocks, which carries higher volatility. But they also start younger, learn faster, and diversify earlier thanks to fractional investing and social platforms.

How do Gen Z investors benefit from social trading?

Social trading provides community, shared learning, and transparency. It helps beginners learn strategies in real time while reducing the intimidation factor of traditional finance.

What role does ESG play in Gen Z investing?

ESG is central. Gen Z investors 2025 often avoid companies with poor environmental or social records. For them, sustainable finance isn’t optional—it’s part of financial identity.

Conclusion & Next Steps for Gen Z Investors 2025

The rise of Gen Z investors 2025 is one of the most important shifts in modern finance. Their digital-first habits, demand for sustainability, and preference for transparency are transforming how markets function. They’re pushing institutions to evolve, driving innovation in fintech, and reshaping wealth management across the globe.

For businesses, the message is clear: adapt to their expectations, or risk being left behind. For regulators, the challenge is protecting young investors without smothering innovation. And for Gen Z themselves, the opportunity is vast—but so are the risks.

As always, this article is for educational purposes only, not financial advice.

The next decade belongs to a generation rewriting the rules of global finance—one trade, one app, and one value-driven decision at a time.

1 thought on “Gen Z Investors 2025: How a New Generation Is Reshaping Global Finance”