Introduction: Why Crypto FOMO 2025 Matters

Crypto FOMO 2025 is shaping the way investors behave in global markets. With the Bitcoin surge 2025 driving headlines, the fear of missing out has become one of the most powerful forces influencing decision-making. Whether you’re in the USA, UK, France, or the UAE, emotional trading has become both an opportunity and a risk. Understanding the psychology behind crypto FOMO 2025 is essential for anyone who wants to navigate this fast-moving digital-first investing landscape.

Understanding Crypto FOMO 2025

The Psychology Behind Fear of Missing Out

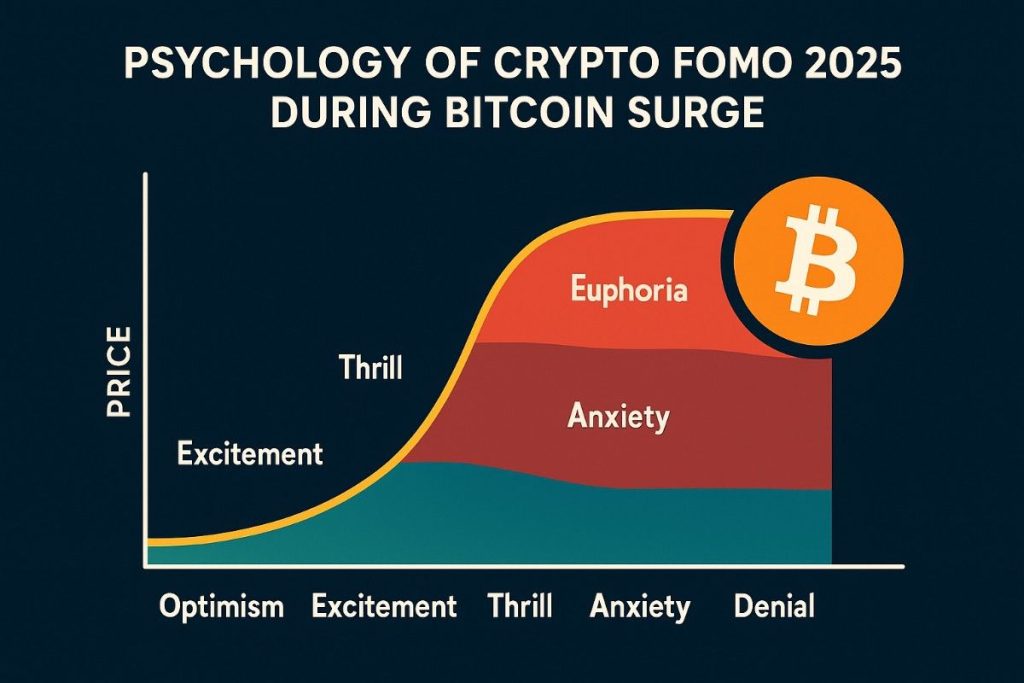

FOMO isn’t new, but in 2025, its grip on crypto investors is stronger than ever. Behavioral finance shows us that people are more motivated by fear of loss than by the potential for gain. When prices rise quickly, as with Bitcoin surge 2025, investors fear being left behind. This emotional drive can push them to make decisions that don’t align with long-term financial goals.

How Bitcoin Surge 2025 Amplifies Investor Emotions

The Bitcoin surge 2025 has turned crypto into dinner table conversation again. Every time Bitcoin breaks another milestone, the excitement multiplies. For many, headlines alone feel like trading signals. This amplifies the cycle of emotional investing risks. When prices rise, greed kicks in; when volatility strikes, fear takes over. The result is often irrational trading behavior rather than rational wealth management.

Crypto FOMO 2025 & Market Behavior

Gen Z vs. Millennials: Different Approaches to Crypto

Crypto FOMO 2025 affects generations differently. Gen Z, digital-first by nature, often embraces fractional crypto investing and social trading platforms. They see crypto as a normal part of wealth building.

Millennials, on the other hand, may balance crypto with traditional assets, though many still chase the upside during a Bitcoin surge. Both groups share one thing: FOMO can push them into trades they later regret.

The Role of Social Trading in Driving FOMO

Social trading crypto platforms make FOMO stronger than ever. When investors see others posting big wins online, the urge to replicate those gains intensifies. Copy-trading features turn emotional decisions into community-wide trends. This collective momentum, fueled by influencers and viral posts, reinforces behavioral finance patterns where perception matters more than fundamentals.

Opportunities Created by Crypto FOMO 2025

Bitcoin Surge & New Investment Pathways

The Bitcoin surge 2025 isn’t just hype—it’s opening new pathways for investors. Fractional crypto investing has lowered barriers, allowing more people to enter high-stakes markets without overexposing themselves. Digital-first investing 2025 also means investors can use AI robo advisors crypto tools to balance portfolios. Instead of only chasing headlines, these tools help individuals create structured strategies.

Institutional Adoption and Market Expansion

Crypto FOMO 2025 is also influencing institutions. From wealth management firms in London to family offices in Dubai, large players are expanding into digital assets. Their involvement increases legitimacy, draws regulatory clarity, and encourages mainstream adoption. For everyday investors, institutional adoption creates more options, from crypto ETFs to structured investment products. This expansion shows that FOMO doesn’t just affect individuals—it shapes entire financial ecosystems.

Risks & Challenges in Crypto FOMO 2025

Emotional Investing & Volatility Risks

The danger of crypto FOMO 2025 lies in its unpredictability. Emotional investing risks are magnified when markets move fast. Investors often buy high and sell low, driven by short-term panic or excitement. Bitcoin’s history of rapid swings highlights this volatility. For many, the high-stakes trading risks can erode wealth instead of building it. Learning to recognize these patterns is the first step toward resilience.

Regulatory Oversight & Market Stability

Crypto regulation 2025 is becoming more defined, but rules vary by region. In the USA, oversight focuses on investor protection. The UK leans toward risk disclosure. France emphasizes compliance with EU frameworks. The UAE stands out with innovation-friendly policies, balancing oversight with growth. For investors, regulations mean both protection and limits. Misunderstanding local rules can lead to costly mistakes, adding another layer to FOMO-driven risks.

Business Impact of Crypto FOMO 2025

How Fintechs and Exchanges Adapt

Fintech firms and exchanges are adapting quickly to crypto FOMO 2025. Platforms now integrate behavioral finance crypto insights, nudging investors toward more balanced decisions. Exchanges in Dubai and London have started adding educational features that explain volatility risks. The goal is clear: keep users engaged without letting them burn out from reckless trading.

Traditional Banks Entering the Crypto Arena

Banks once cautious are now entering the arena. In the UK, major banks offer crypto custody solutions. MeanwhileFrance, partnerships with exchanges are growing. In the UAE, banks explore digital-first investing 2025 strategies, often catering to high-net-worth clients. By entering the space, traditional finance institutions add stability, though their presence also signals that crypto is no longer just a niche play.

Regional Insights on Crypto FOMO 2025: USA, UK, France & UAE

Regulatory Trends Across Markets

Each region approaches crypto FOMO 2025 differently. The USA focuses on compliance, making sure exchanges follow strict rules. The UK fosters innovation but requires investor warnings. France aligns with EU-wide crypto regulation 2025. Meanwhile, the UAE takes a global leadership role, positioning Dubai and Abu Dhabi as hubs for blockchain finance. These diverse frameworks shape how investors experience FOMO across borders.

Adoption Patterns Among Investors & Businesses

In the USA, crypto investing habits often lean toward speculation during surges. The UK market shows more cautious adoption, especially among millennials balancing portfolios. France sees a blend of retail enthusiasm and institutional caution. The UAE stands out for high adoption among both individuals and businesses, reflecting its broader vision for global crypto finance.

“A deeper look at how Gen Z is reshaping global finance can be found in our piece on Gen Z Investors 2025.”

Understanding these patterns helps investors see that FOMO is cultural as much as psychological.

FAQs on Crypto FOMO 2025

Why is crypto FOMO stronger in 2025?

Crypto FOMO 2025 is stronger because Bitcoin surge 2025 has reignited mainstream interest. Add to that social trading, real-time updates, and widespread adoption, and the sense of urgency has never been higher.

How can investors manage emotional decisions in crypto?

Managing emotional decisions starts with awareness. Using AI robo advisors crypto tools, setting limits, and diversifying portfolios can reduce impulsive trades. Investors should also pause before reacting to market swings, turning FOMO into strategy rather than panic.

What role does Bitcoin surge 2025 play in market psychology?

Bitcoin surge 2025 is the spark that ignites emotional trading. Rising prices validate early adopters while pressuring newcomers to jump in. This cycle feeds crypto FOMO psychology, where perception often drives decisions more than data.

Conclusion & Next Steps for Crypto FOMO 2025

Crypto FOMO 2025 reflects both the promise and the risks of digital-first investing. The Bitcoin surge 2025 has made crypto more visible, but emotions remain the biggest challenge. Investors across the USA, UK, France, and the UAE must learn to balance excitement with discipline.

Using structured tools, understanding regulations, and resisting impulsive trades will be key.

As global crypto finance matures, managing FOMO is no longer optional—it’s a skill every investor needs.

Remember: this article is for educational purposes only, not financial advice.

1 thought on “Crypto FOMO 2025: Managing Emotion in the Bitcoin Surge”