Introduction: Why De-Dollarization 2025 Matters

The global financial system is facing a pivotal moment. For decades, the US dollar has stood as the dominant reserve currency, underpinning international trade and investment flows. Yet, the narrative is shifting. With geopolitical realignments, economic uncertainty, and a renewed appetite for hard assets, de-dollarization 2025 is becoming more than a theoretical debate—it’s a lived reality. At the center of this movement stands gold, reclaiming its historical role as a cornerstone of financial security.

For investors, policymakers, and institutions alike, the implications of this shift are profound. From reserve diversification strategies to the rising importance of safe haven assets, the world is quietly preparing for a seismic transformation in monetary order.

What is De-Dollarization?

Defining De-Dollarization in 2025

At its core, de-dollarization refers to reducing reliance on the US dollar in international transactions, reserves, and settlement systems. By 2025, this trend is accelerating, driven by trade blocs, emerging economies, and even Western allies seeking to mitigate exposure to US monetary policy and sanctions.

A global reserve currency shift doesn’t mean the immediate collapse of the dollar. Instead, it reflects a gradual diversification, where gold, the euro, yuan, and even digital assets play a larger role in central bank portfolios.

The BRICS De-Dollarization Strategy

Perhaps the most visible driver of de-dollarization is the BRICS coalition. Their de-dollarization strategy 2025 hinges on settling trade in local currencies, expanding the use of the yuan in commodity contracts, and bolstering collective gold reserves.

The petroyuan vs petrodollar 2025 debate exemplifies this trend. As energy producers experiment with yuan-denominated oil sales, the dollar’s dominance in energy markets—long a bedrock of its strength—faces unprecedented competition.

Why Central Banks Are Buying Gold in 2025

Central Bank Gold Buying & Global Trends

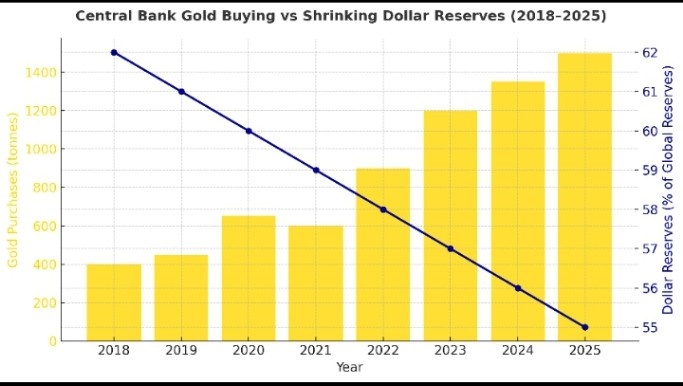

Central banks are the quiet architects of this new era. In 2025, central bank gold buying is not just a hedge but a deliberate reserve diversification strategy. According to the latest data, emerging markets and even developed economies are allocating more reserves toward gold as a counterweight to dollar decline 2025 risks.

The gold prices 2025 forecast reflects this demand surge. As institutional inflows into gold ETFs 2025 grow and physical reserves expand, gold continues to serve as a stabilizing anchor amid volatility.

Case Studies: China, India & UAE

China gold accumulation has been relentless, reinforcing its push to internationalize the yuan.

Moreover, India gold buying 2025 highlights both cultural affinity and strategic intent, strengthening financial buffers against external shocks.”

The UAE gold market outlook showcases Dubai’s ambition to become a global hub for physical bullion trade and digital gold products, bridging East and West.

Gold vs US Dollar – The Battle of Safe Havens

Gold as an Inflation Hedge Asset in 2025

In a world grappling with persistent inflation and geopolitical uncertainty, the gold vs US dollar debate is intensifying. Investors increasingly view gold as a more reliable inflation hedge than the greenback, especially as US dollar crisis 2025 fears gain traction.

Safe Haven Investments & Dollar Decline

Traditionally, both gold and the dollar have acted as safe haven assets. Yet today, with the USD losing dominance, gold appears more neutral, untethered from domestic political risk. Institutional investors, from sovereign wealth funds to pension managers, are strategically rebalancing toward metals and away from overexposure to fiat currencies.

How De-Dollarization Affects Global Trade & Investors

Reserve Currency Shift & Forex Traders

The global reserve currency shift reverberates across foreign exchange markets. For forex traders, de-dollarization 2025 introduces new volatility patterns.

For readers following the rise of digital assets, our previous piece on Crypto Fomo 2025 Managing Emotion in the Bitcoin Surge explores how investor psychology is shaping the parallel crypto narrative.”

Currency pairs tied to commodities and gold-backed strategies may gain traction as hedges against dollar fluctuations.

De-Dollarization, Oil Markets & Cryptocurrency

Energy trade is a frontline of change. The contest between the petroyuan vs petrodollar 2025 framework could redefine pricing norms in oil markets.Simultaneously, cryptocurrencies and gold-backed stablecoins 2025 provide alternative channels for settlement; however, because they are not yet mainstream, tokenized assets nevertheless complement the broader move toward financial diversification.”

Investment Opportunities in the Gold Resurgence

Best Gold Investment Strategies in 2025

For investors seeking exposure, opportunities span across:

Physical bullion for long-term wealth preservation.

Gold ETFs inflows 2025, offering liquidity and accessibility.

Mining equities, tied to commodity cycles.

Allocations to gold via retirement portfolios or sovereign funds.

Strategically, balancing gold allocations alongside equities and bonds enhances portfolio resilience.

Tokenized Gold Assets & Stablecoins

The digital wave is impossible to ignore.

In addition, tokenized gold assets and digital gold investing apps democratize access, particularly for younger investors who are seeking modern ways to participate in precious metals markets. Furthermore, these digital platforms lower traditional barriers to entry by offering fractional ownership, seamless trading, and user-friendly interfaces, which encourage broader participation across different age groups and regions. Moreover, the rise of gold-backed stablecoins 2025 blends the timeless stability of physical metals with the efficiency of blockchain technology, thereby creating instruments that combine trust with innovation. Consequently, these stablecoins remain appealing to both retail investors, who value accessibility, and institutional players, who prioritize security and transparency. Ultimately, the convergence of tokenized assets, digital applications, and blockchain-backed instruments demonstrates how technology is reshaping gold investment strategies and, at the same time, reinforcing gold’s role as a central safe haven asset in the era of de-dollarization 2025.”

Regional Perspectives on De-Dollarization 2025: USA, UK, France & UAE

Dollar Risks in the USA & Western Response

Within the US, acknowledgment of dollar decline 2025 risks is muted but real. Washington recognizes that weaponizing financial sanctions has accelerated calls for alternatives. The Western response has included reinforcing trust in Treasury markets and exploring central bank digital currencies.

Europe’s Gold Reserves: UK & France

Europe plays a subtle yet important role. The France gold reserves 2025 position remains one of the largest in the world, underpinning its financial credibility. The UK, though less vocal, continues to hold significant reserves, serving as a stabilizer in times of market stress.

UAE Gold Market Outlook & Dubai’s Role

Dubai is emerging as a linchpin. The UAE gold market outlook is buoyed by strong demand, regulatory innovation, and infrastructure that supports both physical and digital trading. Positioned at the crossroads of East and West, Dubai is uniquely placed to benefit from the gold resurgence tied to de-dollarization.

FAQs on De-Dollarization 2025

Is the US dollar losing its reserve currency status?

Not immediately, but the USD losing dominance is undeniable. The dollar’s share of global reserves is shrinking as diversification into gold and other assets accelerates.

Why are central banks buying so much gold?

Because gold acts as insurance against currency volatility, inflation, and geopolitical shocks. Central bank gold buying also reduces exposure to potential US dollar crisis 2025 scenarios.

Is gold a better investment than Bitcoin in 2025?

Gold and Bitcoin serve different roles. Gold remains a proven safe haven asset 2025, while crypto is still evolving. Many investors hold both, but gold’s neutrality appeals to central banks in ways Bitcoin cannot.

How does de-dollarization impact oil markets?

Energy trade could see profound changes. The petroyuan vs petrodollar 2025 competition is reshaping how oil is priced, and in turn, how nations manage reserves.

Conclusion & Next Steps in the Gold Resurgence

The forces driving de-dollarization 2025 are structural, not cyclical. Gold’s resurgence is less about nostalgia and more about resilience an acknowledgment that in times of uncertainty, hard assets preserve trust.

Therefore, for investors, this shift means rethinking portfolios and adjusting long-term allocations toward more resilient assets. Meanwhile, for policymakers, it demands recalibrating reserve strategies in order to balance exposure between the dollar, gold, and emerging alternatives. Moreover, for nations, it marks a subtle but historic shift in the balance of power, signaling that financial influence is no longer concentrated in a single currency. Ultimately, this global adjustment reflects a broader trend of diversification that is reshaping how economies prepare for future uncertainty.”

In addition, tokenized gold assets and digital gold investing apps democratize access, particularly for younger investors. Furthermore, these innovations expand market participation by lowering traditional barriers to entry. Moreover, gold-backed stablecoins 2025 blend the stability of metals with blockchain efficiency, and therefore they remain appealing tools for both retail and institutional use. Consequently, the convergence of physical gold with digital platforms is reshaping how investors view safe haven assets in 2025.”

Educational purposes only, not financial advice.

1 thought on “De-Dollarization 2025 & Gold Resurgence”