Introduction: Why Green Finance 2025 Matters

Green finance 2025 stands at the center of the global economic transformation. Financial hubs compete to channel institutional capital toward renewable energy, climate adaptation, and sustainable growth. Consequently, cities from London to Abu Dhabi now market themselves as leaders in the global sustainable investing race. Moreover, trillions in institutional green capital flows highlight that sustainability is not a trend but the new foundation of finance. For professionals, investors, and policymakers, the question is no longer whether to engage in green finance but how to stay competitive as the market matures.

What is Green Finance?

Defining Green Finance in 2025

Green finance in 2025 refers to the system of investments designed to support environmental sustainability while producing competitive returns. Therefore, it includes products such as green bonds, renewable infrastructure finance, climate adaptation funds 2025, and sustainable ETFs 2025. Moreover, the sector has evolved beyond early ESG screening models. Today, investors demand measurable climate outcomes and transparent reporting frameworks. As a result, regulators, banks, and sovereign wealth funds climate shift agendas align capital flows with net zero finance strategies.

ESG vs Resilience Investing

ESG once dominated the sustainability conversation. However, resilience investing now plays a critical role by targeting projects that prepare economies for climate shocks. Consequently, portfolios include climate adaptation funds 2025 designed to finance flood defenses, renewable grids, and heat-resilient housing. Moreover, investors realize that ignoring climate resilience exposes them to systemic financial risks. Therefore, ESG and resilience investing increasingly complement one another, combining corporate responsibility with strategies that strengthen infrastructure and markets.

Global Hubs Competing for Green Finance Leadership

London’s Transition Finance Strategy

London continues to position itself as one of the strongest sustainable finance hubs 2025. The London green finance strategy emphasizes transition funding for carbon-intensive industries moving toward low-carbon models. Consequently, the transition finance council UK ensures capital supports viable corporate shifts rather than divestment alone. Moreover, London promotes carbon transition investments through disclosure standards and new climate-linked derivatives. As a result, the city remains central in Europe’s green finance ecosystem, despite growing competition.

Abu Dhabi’s $30B Climate Fund

The Abu Dhabi climate fund 2025 signals the Gulf’s ambition to lead in sustainable finance. With $30 billion committed, the fund invests in renewable infrastructure finance, sustainable fintech innovation, and large-scale carbon capture. Moreover, the UAE green finance outlook reflects a strategic plan to diversify away from oil. Consequently, Abu Dhabi aims to attract institutional green capital flows from Europe, the US, and Asia. Ultimately, this sovereign-led initiative reinforces the UAE’s position in the climate finance competition 2025.

Singapore and Asia’s Green Push

Singapore green Wall Street aspirations continue to grow. The city-state develops tax incentives, green bond frameworks, and digital solutions that track carbon transition investments. Consequently, it serves as a marketplace for Asia’s renewable projects, which require trillions in new financing. Moreover, Singapore encourages sustainable fintech innovation to integrate transparency and accessibility into climate funding. Therefore, the hub plays a decisive role in directing regional and global flows toward sustainable assets.

Green Bonds & Climate Capital Flows

Growth of Green Bond Markets 2025

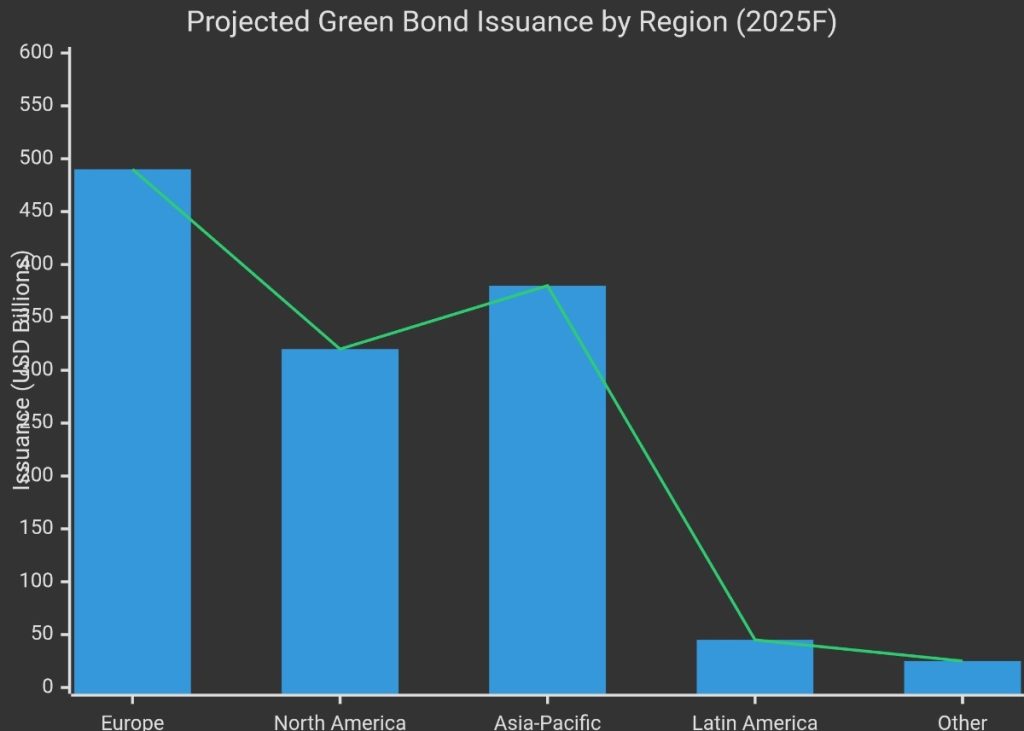

Green bond markets growth remains one of the defining features of green finance 2025. France sustainable bonds 2025 lead issuance in Europe, while China dominates Asia’s share. Moreover, regulatory support and rising investor demand secure competitive yields.

Consequently, proceeds fund renewable infrastructure, transport upgrades, and climate adaptation initiatives. As a result, green bonds continue to anchor the global sustainable investing race and provide investors with liquid, transparent vehicles.

Institutional Investors & Sovereign Wealth Funds

Institutional investors integrate net zero finance strategies across asset classes. Pension funds in the US and UK allocate more to sustainable ETFs 2025, while Middle Eastern sovereign wealth funds climate shift agendas finance renewable megaprojects. Moreover, these flows demonstrate that climate finance is not cyclical. Instead, it is a structural shift in global markets. Consequently, institutional investors act as both catalysts and stabilizers for long-term sustainable growth.

How Green Finance Impacts Global Trade & Policy

Net Zero Finance and Energy Transition

Net zero finance strategies directly influence trade and industrial policy. Consequently, exporters disclose carbon footprints to qualify for supply chain financing. Moreover, renewable infrastructure finance expands energy security while reducing dependence on fossil fuels. Therefore, net zero commitments reshape alliances and trade flows, as countries prioritize green partnerships and carbon-aligned investment frameworks.

Climate Finance Competition Between Regions

Climate finance competition 2025 intensifies as hubs from London and Paris to Singapore and Abu Dhabi compete for leadership. Moreover, each region introduces new regulatory frameworks to attract institutional green capital flows. Consequently, innovation increases, but fragmentation risks also rise. Therefore, policymakers must ensure international cooperation while encouraging regional competition that drives progress.

Global finance is shifting not only through climate-driven investments but also through evolving currency strategies. To explore how de-dollarization and gold are reshaping capital flows, read our article on De-Dollarization 2025 & Gold Resurgence

Investment Opportunities in Green Finance 2025

Green ETFs & Sustainable Funds

Sustainable ETFs 2025 attract diverse investor groups seeking transparency, liquidity, and alignment with ESG goals. Moreover, thematic funds targeting renewable energy, electric mobility, and circular economy models grow rapidly. Consequently, both retail and institutional investors embrace these products as accessible vehicles to support net zero finance strategies. Therefore, sustainable ETFs represent one of the most scalable entry points into green finance 2025.

Renewable Infrastructure and Carbon Transition

Renewable infrastructure finance underpins the sector’s expansion. Consequently, solar farms, offshore wind, and smart grid modernization attract significant institutional green capital flows. Moreover, carbon transition investments provide opportunities in technologies that reduce emissions in energy-intensive industries. Therefore, investors balance exposure to pure renewable plays with projects that manage the transition from fossil fuels. Ultimately, this dual approach builds both sustainability and resilience into portfolios.

Regional Perspectives on Green Finance 2025: USA, UK, France & UAE

USA Policy Shifts and Investor Trends

The US expands climate adaptation funds 2025 to strengthen resilience for coastal cities and key infrastructure. Moreover, institutional investors integrate climate risk into asset allocation strategies. Consequently, Wall Street banks design sustainable ETFs 2025 that appeal to a growing retail base. Therefore, US policy and market behavior align more closely with global green finance 2025 trends.

Europe’s Green Bond Market: UK & France

France sustainable bonds 2025 anchor Europe’s leadership in green issuance. Moreover, Paris seeks to surpass London by developing frameworks that attract sovereign wealth funds and institutional green capital flows. However, the London green finance strategy and transition finance council UK ensure the city remains competitive. Consequently, Europe benefits from having two strong hubs driving growth in climate finance.

UAE Green Finance Outlook & Abu Dhabi’s Role

The UAE green finance outlook demonstrates national ambition to lead in sustainable markets. Consequently, Abu Dhabi’s $30 billion climate fund 2025 positions the Gulf as a serious competitor in the global sustainable investing race. Moreover, sovereign wealth funds in the region diversify into renewable infrastructure finance, sustainable fintech innovation, and adaptation projects. Therefore, Abu Dhabi plays a vital role in shaping climate finance competition 2025.

FAQs on Green Finance 2025

Is ESG being replaced by resilience?

Resilience investing does not replace ESG. Instead, it expands the framework by focusing more directly on climate shocks. Consequently, investors combine ESG principles with adaptation strategies to build stronger portfolios. Moreover, both approaches now complement one another in practice.

Why are sovereign funds investing in climate?

Sovereign wealth funds climate shift agendas balance diversification with national transition goals. Consequently, they reduce reliance on fossil fuel revenues while supporting renewable infrastructure. Moreover, these funds see climate finance as a long-term growth opportunity. Therefore, their capital accelerates the development of sustainable markets.

Are green bonds still profitable in 2025?

Yes, green bond markets growth demonstrates strong investor demand. Moreover, regulatory incentives and reliable yields maintain their appeal. Consequently, France sustainable bonds 2025 and other benchmarks show that profitability and sustainability can align. Therefore, green bonds remain central to green finance 2025.

How does green finance affect energy markets?

Green finance 2025 accelerates the global energy transition. Consequently, capital shifts toward renewables, storage, and grid innovation. Moreover, it changes how investors allocate across the sector, rewarding companies aligned with carbon transition investments. Therefore, green finance shapes both supply and demand in energy markets.

Conclusion & Next Steps in Sustainable Finance

Green finance 2025 defines the next phase of global markets. Consequently, hubs such as London, Abu Dhabi, Singapore, Paris, and New York compete to lead in the global sustainable investing race. Moreover, institutional investors sovereign funds, and policymakers collectively push capital toward renewable infrastructure finance, sustainable ETFs 2025, and climate adaptation funds 2025.

Therefore, professionals must understand both opportunities and risks in this evolving ecosystem.

Ultimately, green finance 2025 is not optional. It is the structural foundation of future markets. Educational purposes only, not financial advice.

1 thought on “Green Finance 2025 Outlook”