Introduction: Why the BlackRock Bullish Market Outlook Matters

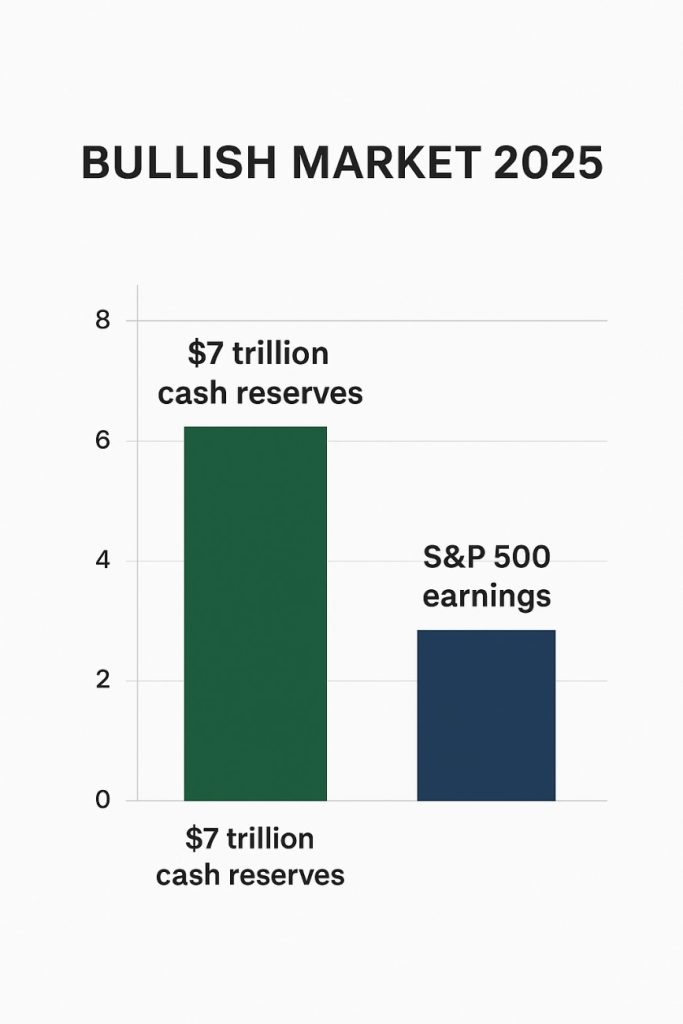

The BlackRock bullish market outlook has captured global attention in 2025. Rick Rieder, the firm’s Chief Investment Officer who oversees $2.4 trillion in assets, called this year the most bullish investing environment ever. His statement carries weight because of the data backing it: $7 trillion in cash still sits idle, central banks are cutting rates, and Big Tech earnings continue to surge. Investors across the USA, UK, France, and the UAE want to know how to act on this signal. The message is clear. Markets are entering a decisive phase where opportunity and risk exist side by side.

Who is Rick Rieder and Why Investors Listen

BlackRock’s $2.4 Trillion Reach

Indeed, Rick Rieder is not just another analyst. In fact, he manages BlackRock’s global fixed income strategy, which directly influences markets worldwide. Moreover, BlackRock’s $2.4 trillion manager bullish stance matters because institutions, sovereign wealth funds, and pension systems closely track its positioning. Consequently, when such an influential figure declares a BlackRock bullish market 2025 outlook, it sets the tone for institutional as well as retail investors alike.

The Case for a Bullish Market

Rieder argues that the combination of massive liquidity, supportive monetary policy, and strong earnings creates the most bullish investing environment ever. Unlike past cycles, the depth of cash on the sidelines is unprecedented. BlackRock bullish vs bearish views have tilted decisively in favor of equities. This perspective frames how capital allocation may shift across asset classes in the coming quarters.

Key Drivers Behind the BlackRock Bullish Market Call

$7 Trillion in Cash Waiting to Invest

One of the strongest pillars in the Rick Rieder bullish market outlook 2025 is the $7 trillion cash waiting to invest. In fact, this mountain of liquidity remains unallocated due to prior market uncertainty.

Once confidence grows, this capital could move into equities, bonds, and alternative assets, thereby pushing valuations higher. As a result, the potential deployment of this cash makes the BlackRock bullish market outlook USA UK France UAE particularly relevant for global institutions.

Fed Rate Cuts Fueling the BlackRock Bullish Market Outlook

The Fed rate cut expectation September 2025 plays a central role. With borrowing costs falling, corporate financing becomes cheaper, fueling expansion. Lower rates also push investors to seek higher yields in risk assets. Fed rate cuts 2025 tech earnings rally dynamics already show stronger flows into growth sectors. Monetary easing in the UK and Europe supports a similar trend, amplifying the global investor optimism 2025 BlackRock has highlighted.

Big Tech Earnings Growth Supporting the BlackRock Bullish Market

Big Tech year over year earnings growth has outpaced expectations, with some firms reporting 54 percent increases. Around 81% of the S&P 500 beat earnings estimates 2025, reinforcing the bullish tone. Big Tech earnings growth 2025 stats underline why AI space data investment BlackRock strategies are gaining traction. Tech remains the central growth driver for equity markets, with AI, semiconductors, and cloud infrastructure leading performance.

Opportunities Emerging from the BlackRock Bullish Market

U.S. Equities and Corporate Buybacks in the BlackRock Bullish Market

Record corporate buybacks 2025 impact cannot be overlooked. Companies are using cash reserves to buy back shares, reducing supply and boosting stock prices. Combined with the $7 trillion cash waiting to invest, the effect compounds. U.S. equities are well-positioned in this environment. Moreover, this strength gives weight to the BlackRock bullish market UK analysis and France sentiment. In addition, European investors often follow U.S. momentum, which reinforces the global impact of Wall Street trends.

Tech and AI Investment Outlook

AI remains central. AI space data investment used by BlackRock illustrates how asset managers now treat AI as both a productivity enhancer and an investable theme. Growth in AI, cloud, and data-driven companies adds fuel to the BlackRock $2.4 trillion manager bullish outlook. The convergence of technology and finance creates fresh opportunities for portfolio expansion.

Global Investor Optimism Across Regions

Global investor optimism 2025 BlackRock surveys confirm confidence in U.S. markets. Moreover, interest in the UK, France, and UAE remains strong. In addition, sovereign wealth funds in the UAE are aligning with this bullish view. At the same time, European pension funds see opportunities in green transition finance and tech-linked growth. Furthermore, the BlackRock bullish outlook UAE investors follow clearly reflects their role as long-term allocators.

Risks and Contradictions in the Bullish Market Outlook

Tariffs, Trade Tensions, and Market Shocks

Investor risk perception tariffs concerns cannot be dismissed. The U.S. and Europe face trade frictions that may escalate. Tariff disputes could disrupt supply chains and increase costs, reducing profitability. While the BlackRock bullish market 2025 outlook emphasizes opportunity, market shocks remain possible.

Bubble Concerns in Tech and AI

Some analysts warn of bubbles forming in AI-linked stocks. With valuations stretched, the risk of correction grows. The BlackRock bullish vs bearish views debate is strongest here, as not all institutions agree that momentum justifies current valuations. Tech optimism must be balanced with risk awareness.

Bearish Counterarguments from Other Analysts

Other firms argue that slowing consumer demand and global political instability could trigger downturns. The BlackRock market outlook USA UK France UAE remains constructive, but contrasting opinions highlight why diversification is key. Not every investor shares the same risk tolerance or time horizon.

Regional Perspectives on the Bullish Market Outlook

USA: Fed Cuts and Wall Street Momentum

The BlackRock bullish environment USA 2025 centers on Fed policy and Wall Street performance. U.S. equity strength influences global sentiment, and the combination of rate cuts and corporate earnings supports continued flows into stocks.

UK and France: European Investor Sentiment

The BlackRock bullish market UK analysis points to investor positioning around FTSE-listed companies and London’s role as a financial hub. In France, sustainable bonds and infrastructure-linked opportunities add to the narrative. BlackRock investor sentiment France 2025 reflects optimism tied to both corporate earnings and Eurozone monetary easing.

UAE: Sovereign Wealth and Global Diversification

The BlackRock bullish outlook UAE investors follow connects directly to sovereign wealth strategies. Abu Dhabi and Dubai funds are diversifying into AI, infrastructure, and U.S. equities. This global diversification aligns with the opportunities highlighted in Rick Rieder’s view.

Investment Strategies in a Bullish Market

Balancing Equities and Bonds

First, investors can balance equities and bonds to capture upside while limiting risk. Moreover, the BlackRock bullish market 2025 thesis favors equities, yet bonds remain useful for stability, especially as yields adjust to policy shifts. In addition, maintaining this balance helps investors protect portfolios while still participating in growth. Therefore, disciplined allocation becomes critical for navigating opportunities without exposing portfolios to excess volatility.

Sector Plays: Tech, Finance, and Energy

Tech leads growth, but finance and energy cannot be ignored. The Fed rate cuts 2025 tech earnings rally highlights tech, yet banks benefit from economic activity and energy plays support diversification. A balanced allocation across sectors reflects prudence.

Global Diversification and Risk Management

Investors in the USA, UK, France, and UAE should consider global diversification. Spreading exposure across markets reduces concentration risk. The BlackRock market outlook USA UK France UAE points to opportunities in both developed and emerging economies.

Sustainability as a Market Driver

Green finance is becoming a core driver of global markets in 2025. Capital is flowing into renewable energy, sustainable infrastructure, and ESG-linked assets at record levels. This shift is shaping long-term growth opportunities that align with BlackRock’s bullish outlook. You can read my full Green Finance 2025 outlook here

FAQs on the BlackRock Bullish Market Outlook

Why does Rick Rieder believe 2025 is bullish?

He cites $7 trillion in cash waiting to invest, supportive Fed policy, and strong corporate earnings as reasons for the most bullish investing environment ever.

How does $7 trillion in cash affect markets?

Once deployed, this cash boosts liquidity and drives valuations higher. It acts as fuel for sustained rallies.

Are tech stocks still safe to buy in 2025?

Yes, opportunities are real. However, resilience is equally necessary. Finally, this content is for educational purposes only, not financial advice.

What risks could derail the bullish outlook?

Tariffs, geopolitical shocks, and potential bubbles in AI or tech could challenge the BlackRock bullish market 2025 forecast.

Conclusion: Positioning for Opportunities and Risks

The BlackRock bullish market 2025 outlook underscores both opportunity and caution. Furthermore, Rick Rieder’s call signals confidence, yet at the same time, investors must balance enthusiasm with risk awareness. In addition, global portfolios should consider equities, tech exposure, and diversification across regions.

As a result, risk-adjusted strategies become essential for those who want to benefit from growth while avoiding potential setbacks. Moreover, whether in the USA, UK, France, or UAE, the message remains consistent. Above all, opportunities are real. However, resilience is equally necessary. Finally, it is important to remember that this article is for educational purposes only, not financial advice.

1 thought on “BlackRock Bullish Market 2025: Outlook and Risks”