Introduction: Why Millionaire Migration and Wealth Shifts Matter

Millionaire migration wealth shifts are reshaping global capital flows. High-net-worth individuals are relocating in record numbers, seeking favorable tax regimes, political stability, and investment opportunities. This movement alters the balance of global wealth distribution and affects markets in both departure and destination countries. For investors and policymakers, understanding these shifts is critical for anticipating risks and capturing opportunities.

Understanding the Global Millionaire Migration Wealth Shifts Trend

Defining Millionaire Migration Wealth Shifts

Millionaire migration describes the relocation of high-net-worth individuals with assets above one million dollars. Wealth shifts global capital flows follow when these individuals move their money, investments, and businesses. As relocation accelerates, capital concentrates in certain economies, while outflows weaken others. This process changes real estate demand, banking trends, and fiscal strategies worldwide.

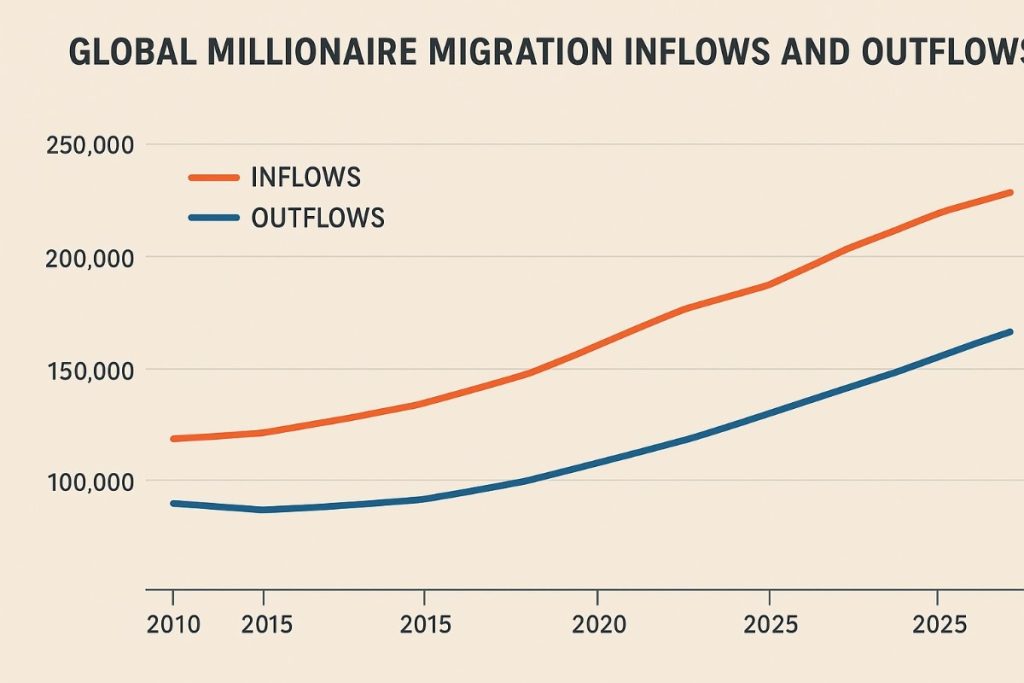

The Scale of Global Millionaire Migration 2025

Global millionaire migration 2025 is set to surpass historical records. Research estimates more than 120,000 wealthy individuals will relocate this year. Popular destinations include the UAE, Singapore, and Australia, while countries like China, Russia, and the UK face outflows. These shifts highlight deeper transformations in global wealth distribution and how capital chooses its new homes.

Key Drivers Behind Millionaire Migration Wealth Shifts

Tax Policy and Millionaire Migration Wealth Shifts

Tax policy driving millionaire migration remains the leading factor. Wealth taxes, inheritance duties, and tightening financial regulations push millionaires toward friendlier jurisdictions. Investors respond quickly to rising fiscal pressure, moving assets to countries offering stability and predictable frameworks. Departure nations often underestimate the scale of wealth flight until revenue bases shrink.

Political Stability, Millionaire Migration Wealth Shits and Lifestyle Preferences

HNWI migration drivers and risks extend beyond taxes. Political stability and quality of life shape relocation choices. Countries with transparent institutions, healthcare access, and safe living environments attract inflows. Regions facing unrest or restrictive policies lose talent and capital. This balance between lifestyle and policy makes certain hubs magnets for wealthy families.

Real Estate ,Millionaire Migration Wealth Shifts and Wealth Relocation Opportunities

Real estate and wealth relocation play a central role in migration decisions. Properties serve as both lifestyle assets and investment vehicles. Wealthy migrants drive demand for luxury homes, commercial buildings, and secondary residences. Cities like Dubai, Sydney, and Singapore benefit from rising real estate inflows. This capital reshapes housing markets and urban economies.

Implications of Millionaire Migration Wealth Shifts for Global Capital Flows

Capital Inflows to New Host Nations

When high-net-worth individuals relocate, host nations gain fresh inflows of capital. These funds boost local economies through investments in businesses, financial markets, and property.

Capital flows impact advanced economies like the UAE and Singapore by strengthening banking systems and reinforcing global financial hub status.

Impact on Real Estate, Finance, and Banking

Wealth shifts global capital flows directly affect real estate, finance, and banking. Private banking adapting to millionaire migration becomes essential, as demand for tailored services increases. Financial institutions expand wealth management divisions to capture new clients. Property developers adjust supply to meet luxury housing demand. These changes create both growth and inflationary pressures.

Outflows and Risks for Departure Countries

Countries losing millionaires face long-term risks. Reduced capital bases weaken domestic investment. Talent flight diminishes innovation and entrepreneurship. Fiscal challenges arise as tax bases shrink. For example, the millionaire migration UK France outlook shows how policy uncertainty can erode wealth stability, creating pressure for reforms to retain capital.

Opportunities for Global Investors in Millionaire Migration Wealth Shifts

Private Banking and Wealth Management Growth

Private banking adapting to millionaire migration has become a growth sector. Banks in Dubai, Singapore, and Zurich expand services tailored for cross-border capital. Asset managers design products to manage global portfolios. For investors, this shift presents opportunities in financial stocks and private equity firms targeting wealth management.

Real Estate Hotspots Linked to Migration

Millionaire migration global hotspots generate lucrative real estate trends. Dubai experiences soaring demand for high-end apartments and villas. Sydney benefits from inflows into prime residential districts. Singapore strengthens its position as a safe haven. Investment shifts from wealthy migrants create opportunities for investors in construction, real estate funds, and property-linked assets.

Emerging Markets and New Investment Destinations

Emerging markets attracting wealthy migrants are gaining momentum. Countries like Greece and Portugal offer residency-by-investment schemes. These attract both capital and long-term development. Investors can benefit by monitoring secondary hotspots where early inflows create undervalued opportunities. Wealth shifts global capital flows reward proactive strategies in these markets.

Risks and Contradictions in Millionaire Migration Wealth Shifts

Policy Backlash and Tax Reform Risks

As millionaire migration grows, governments may respond with new restrictions. Policy reforms shaping millionaire migration include exit taxes and stricter reporting rules. Such measures aim to slow wealth outflows but can backfire by accelerating relocation. Investors must remain cautious of regulatory changes that affect capital flows.

Capital Concentration and Inequality Concerns

Another risk lies in the concentration of wealth. Capital inflows to popular hubs can deepen inequality, pricing out local populations from housing and services. Policymakers face the challenge of balancing inflows with social stability. Investors need to assess the sustainability of growth in these concentrated markets.

Challenges in Tracking Hidden Wealth Flows

Tracking hidden wealth flows remains a challenge. Many relocations involve complex structures, trusts, and offshore accounts. Transparency varies across jurisdictions. This opacity complicates accurate assessments of capital movement. For global investors, incomplete data raises risks when positioning portfolios.

Regional Perspectives on Millionaire Migration

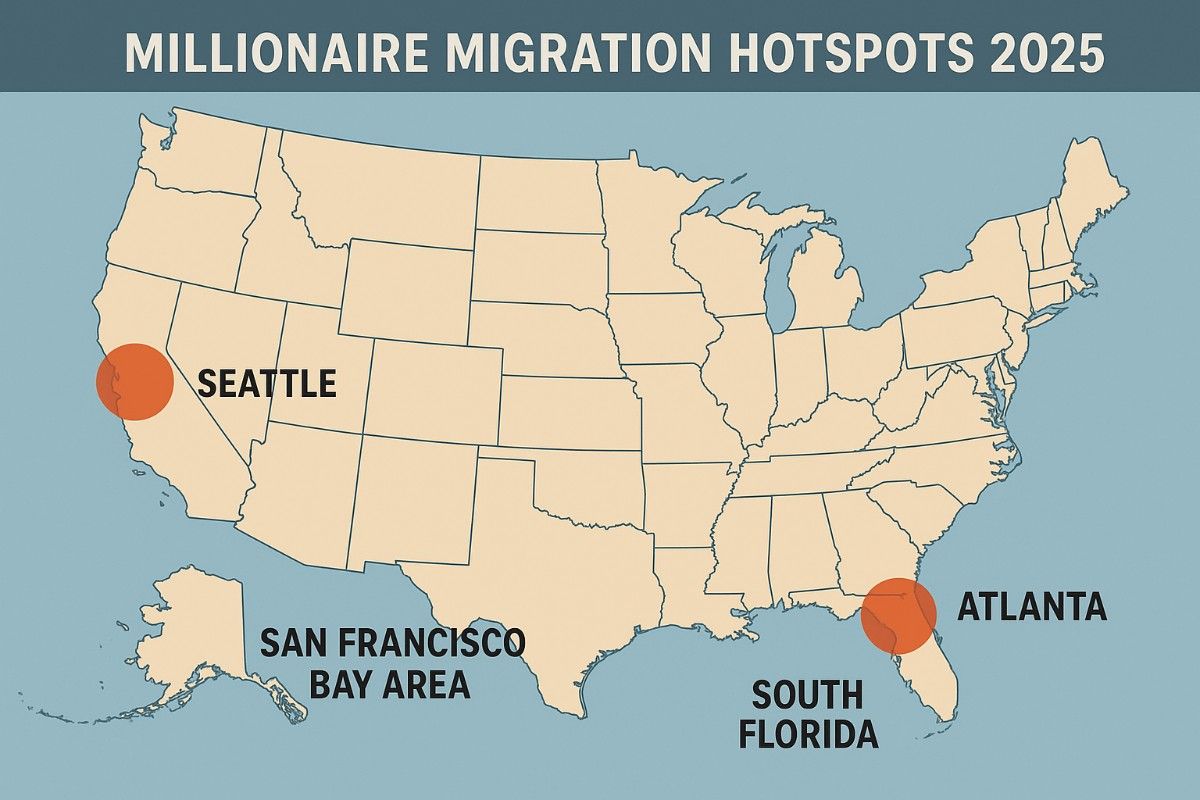

USA: Tax Policy and HNWI Relocation

Millionaire migration USA analysis 2025 shows a mixed picture. Some states lose wealthy residents due to high tax burdens, while others like Florida and Texas attract inflows. This internal redistribution highlights how local policies matter within larger economies. Capital follows states offering favorable tax climates.

UK and France: Wealth Migration Pressures in Europe

The millionaire migration UK France outlook highlights pressure from rising taxes and political uncertainty. Brexit complications and wealth levies have driven wealthy individuals toward Switzerland, Monaco, and the UAE. Both countries must balance fiscal needs with policies that retain high-net-worth individuals.

UAE and Singapore: Wealth Hubs Attracting Capital

Millionaire migration UAE investment trends show the country as a global leader in attracting wealth. Tax-friendly policies, strategic location, and strong infrastructure support inflows. Singapore offers similar advantages, adding political stability and advanced financial services. These hubs benefit from consistent demand across sectors.

Australia: Rising as a Millionaire Migration Magnet

Millionaire migration Singapore and Australia comparisons reveal Australia’s growing role. Sydney and Melbourne attract wealthy families through stable governance, lifestyle advantages, and real estate opportunities. Combined with proximity to Asia, this makes Australia a rising magnet for global wealth.

Strategies for Policymakers and Investors

Managing Capital Inflows Responsibly

Host nations must manage inflows responsibly. Infrastructure, housing, and regulatory frameworks need adaptation to avoid overheating markets. Responsible planning ensures that migration-driven growth benefits both migrants and local citizens.

Diversification in Global Portfolios

For investors, diversification in global portfolios is essential. Exposure to real estate, private banking, and emerging markets offers balanced opportunities. Wealth shifts global capital flows create uneven outcomes, making diversification a shield against volatility.

Preparing for Policy Shifts and Risks

Policymakers and investors must prepare for sudden policy changes. Tax reforms, residency restrictions, and regulatory adjustments can shift migration patterns quickly. Staying informed and flexible remains critical to protecting capital.

BlackRock sees a bullish market ahead in 2025, with technology, infrastructure, and sustainability driving growth. You can read my full analysis of BlackRock’s outlook

FAQs on Millionaire Migration and Wealth Shifts

Why are millionaires migrating in record numbers?

They move for tax benefits, political stability, and lifestyle improvements. These factors combine to drive global millionaire migration 2025.

Which countries gain most from millionaire inflows?

The UAE, Singapore, and Australia rank among the top destinations. They attract wealthy individuals through favorable tax regimes and quality of life.

How does millionaire migration wealth shifts affect global capital flows?

It redirects investments, boosts real estate markets, and strengthens private banking. Departure nations lose tax revenue and entrepreneurial capital.

What risks should investors and governments consider?

Risks include policy backlash, inequality, and lack of transparency. These challenges complicate long-term strategies for investors and governments.

Conclusion: Positioning for Global Millionaire Migration Wealth Shifts

Millionaire migration wealth shifts are altering the global economic landscape. Capital leaves high-tax and unstable regions, flowing toward safe, tax-friendly hubs.

This creates both opportunities and risks across real estate, finance, and policymaking. For investors, diversification and awareness of regional dynamics remain vital. For governments, balancing inflows with sustainable policies is essential. Educational purposes only, not financial advice.

1 thought on “Millionaire Migration and Wealth Shifts”