Why Qatar Strike Market Reaction Matters

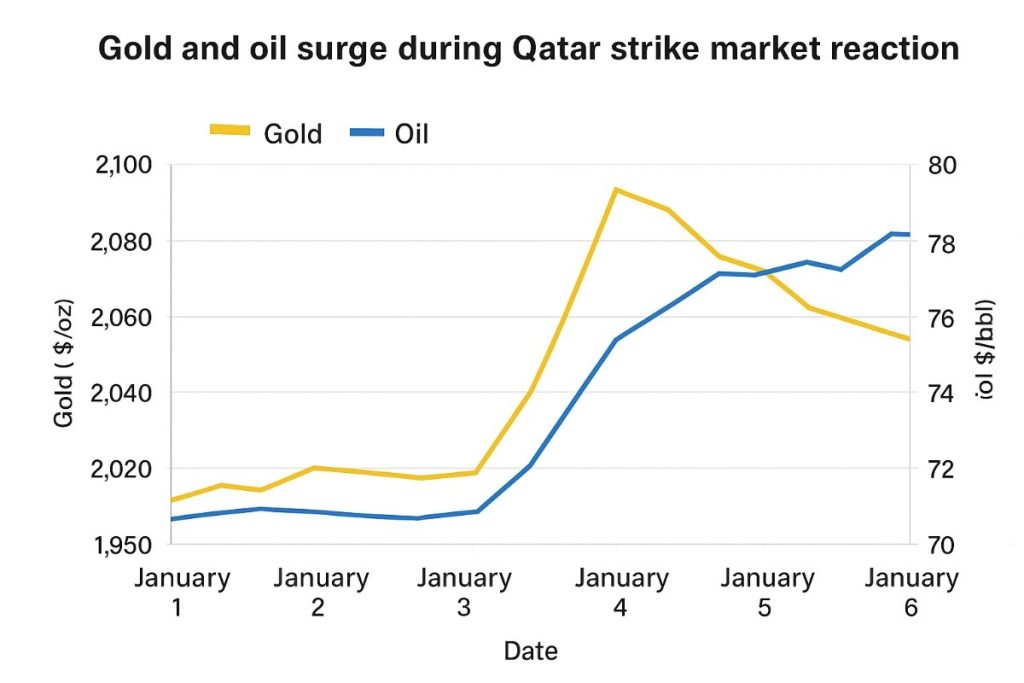

The Qatar strike market reaction highlights how geopolitical shocks ripple across global finance. Within hours of the Israel strike in Qatar, Gulf stock markets 2025 dipped, gold surged to a record, and oil jumped. This movement revealed how safe haven assets 2025 remain central during sudden crises. Investors worldwide watched the Middle East stock reaction closely because disruptions in the Gulf often trigger broader volatility. As capital flows shift, the Qatar conflict finance impact now stands as a crucial case study for policymakers and investors.

Understanding the Market Response to the Qatar Strike

Defining the Geopolitical Market Shock

The Qatar strike market reaction represents a geopolitical market shock that blended military tension with financial fragility. Such shocks differ from normal market corrections because they are sudden and unpredictable. Investors fear escalation, so they reallocate capital quickly. Middle East stock volatility increased because the strike directly hit the region’s financial hub. Global markets after Qatar strike events reveal how interconnected finance is today.

The Scale of Gulf Stock Market Losses

Gulf stock markets 2025 slipped modestly but the dip signaled vulnerability. The Dubai and Abu Dhabi stock reaction showed declines in real estate and banking. Saudi and Qatari equities also dropped. UAE and Saudi stock losses 2025 raised questions about GCC stock performance 2025 in a climate of geopolitical risk markets 2025. Although losses were not catastrophic, they underlined fragility in investor confidence.

Key Drivers Behind the Market Moves

Oil Price Surge After Qatar Strike

Oil price surge 2025 was immediate. Brent and WTI both spiked because investors feared disruption to supply routes. OPEC+ oil response Qatar conflict discussions also fueled speculation. However, gains moderated due to oversupply concerns.

The oil price movement Qatar conflict highlighted how fundamentals and geopolitics clash. Energy traders noted volatility rather than sustained bullish momentum.

Gold as a Safe Haven Asset

Gold price record Qatar underscored the role of gold as a safe haven. Safe haven demand gold oil rose quickly because investors wanted security. The gold surge after Qatar attack 2025 set a new benchmark for safe haven assets 2025. Global investors considered gold an effective hedge even when oil remained volatile. The Qatar strike investor impact proved that trust in gold endures during crises.

Investor Risk Aversion and Volatility

The Qatar strike market reaction also reflected heightened risk aversion. Market volatility Middle East spiked as traders pulled back from riskier assets. Global investor strategy Qatar strike discussions turned toward hedging and diversification. Short-term selloffs in equities paired with inflows into safe haven flows gold and dollar. This illustrated how geopolitics can trigger sharp yet temporary risk-off behavior.

Implications for Global Markets

Impact on Gulf Stock Exchanges

The Gulf equity selloff 2025 had immediate implications. Dubai and Abu Dhabi stock reaction affected property and banking. Gulf banking stocks after strike events saw reduced investor appetite. GCC stock performance 2025 now reflects sensitivity to geopolitical conflict. While modest, these declines showed how quickly confidence can erode.

Spillover to Banking, Energy, and Real Estate

The Qatar conflict finance impact reached beyond equities. Banking shares lost ground, energy firms adjusted to oil volatility, and real estate stocks dipped. Middle East stock reaction created pressure on credit markets and funding costs. This spillover illustrated how sectoral exposure magnifies geopolitical shocks.

Global Investors and Portfolio Shifts

Global markets after Qatar strike episodes often show shifts in portfolio strategies. Investors reassessed exposure to the Gulf and looked at safer allocations. Some rotated into commodity markets 2025 while others hedged with bonds. Global market stability after Qatar news showed resilience, but portfolio managers adapted rapidly.

Opportunities for Global Investors

Gold and Commodity Allocation

The Qatar strike market reaction created opportunities in gold and commodities. Gold surge after Qatar attack 2025 proved the asset’s relevance. Commodity markets 2025 benefited from renewed demand. Allocating to gold and oil gave investors protection and upside.

Energy Market Exposure and Oil Strategies

Oil price surge 2025 opened tactical opportunities. Traders explored short-term gains in energy derivatives. Long-term investors evaluated energy market exposure cautiously. The oil price movement Qatar conflict showed that short bursts of volatility can be profitable if managed.

Hedging Against Geopolitical Risk

Global investor strategy Qatar strike events included hedging. Safe haven assets 2025 such as gold, dollar, and Treasuries gained appeal. Diversification into uncorrelated assets became a theme. Hedging allowed investors to withstand GCC volatility while benefiting from commodity gains.

Risks and Contradictions in Market Reaction

Oversupply Limits Oil Gains

Despite oil price surge 2025, oversupply capped gains. OPEC+ production plans and high inventories reduced upside. Investors recognized that oil fundamentals can blunt geopolitical rallies. This contradiction highlighted limits to energy as a hedge.

Policy and Diplomatic Uncertainty

Policy uncertainty remains a risk. Israel Qatar tensions 2025 market impact could escalate. Diplomatic negotiations may reduce or intensify volatility. Investors must weigh policy outcomes carefully.

Concentration Risks in Gulf Equities

Gulf equity selloff 2025 revealed concentration risk. Many portfolios overweight banking and energy suffered losses. Diversification proved critical in avoiding deep drawdowns. The Qatar strike investor impact confirmed these risks.

Regional Perspectives on the Qatar Strike Market Reaction

USA: Wall Street’s Limited Volatility

Wall Street showed limited reaction. USA investors treated the Qatar strike market reaction as regional. However, commodity-linked firms gained. U.S. resilience demonstrated that distance tempers volatility.

UK and France: Watching Commodities Closely

UK and France investors watched commodities. Gold price record Qatar and oil price surge 2025 shaped their strategies. European markets recognized the indirect impact on inflation and energy security.

UAE and Saudi Arabia: Direct Market Pressure

UAE and Saudi stock losses 2025 proved the most direct. Dubai and Abu Dhabi stock reaction hit investor confidence. Gulf banking stocks after strike events showed vulnerability. The Qatar conflict finance impact was felt most locally.

Asia-Pacific: Balancing Energy Security and Growth

Asia-Pacific markets balanced energy security with growth. Rising oil prices threatened importers. Singapore, Japan, and Australia adjusted exposure. Asia-Pacific resilience reflected adaptation to Middle East volatility.

Strategies for Policymakers and Investors

Managing Safe-Haven Inflows Responsibly

Policymakers faced safe haven flows gold and dollar. Managing inflows responsibly ensured stability. Central banks balanced reserve assets carefully.

Diversification Across Asset Classes

Investors embraced diversification. GCC stock performance 2025 proved volatile, so portfolios broadened. Commodity allocation, bonds, and global equities gave balance.

Preparing for Future Geopolitical Shocks

Preparing for geopolitical risk markets 2025 became urgent. Scenario planning and stress testing grew in importance. Investors now design strategies that anticipate sudden shocks.

FAQs on Qatar Strike Market Reaction

Why did Gulf stocks dip after the Qatar strike?

Gulf stocks dipped because geopolitical risk reduced confidence. Banking, energy, and real estate led the declines.

How did gold and oil prices react?

Gold price record Qatar highlighted safe haven demand. Oil price surge 2025 reflected supply concerns but gains later eased.

What does Qatar strike market reaction mean for global investors?

It means investors must prepare for volatility. Allocations to gold, commodities, and diverse assets matter.

What risks should investors watch going forward?

They should watch policy uncertainty, concentration risks, and oversupply in oil. Escalation could deepen volatility.

Conclusion: Positioning for Future Geopolitical Market Shocks

The Qatar strike market reaction proved how fast global markets adjust to conflict. Gulf stock markets 2025 fell, gold price record Qatar underscored safe haven demand, and oil price surge 2025 revealed supply concerns.

Global investors adapted with diversification and hedging. Future shocks will bring similar challenges. Educational purposes only, not financial advice.

1 thought on “Markets React to Qatar Strike: Gulf Stocks Slip, Gold and Oil Rise”