Why Qatar Strike Energy Security Matters

Energy security shapes global investment flows, policy choices, and trade relations. The Qatar strike energy security challenge in 2025 is forcing governments and investors to reassess risk. Combined with the Ukraine war gas impact, Asia’s oil and gas strategy faces disruption. LNG supply disruption from Qatar is a key concern for Japan, China, and India, as Asia LNG demand 2025 continues to rise. For global energy security 2025, the Middle East energy markets are at the center of volatility.

Understanding the Energy Security Challenge

Geopolitical Shocks From Qatar and Ukraine

The Ukraine war has already redefined European gas flows. It redirected LNG cargoes toward Europe, raising competition for Asia. The Qatar strike adds a new layer of instability. Gulf energy exports 2025 face delays, while LNG shipping routes Asia encounter higher insurance and freight costs. Investors track both shocks as they reshape global energy security 2025.

LNG Supply Risks for Asia

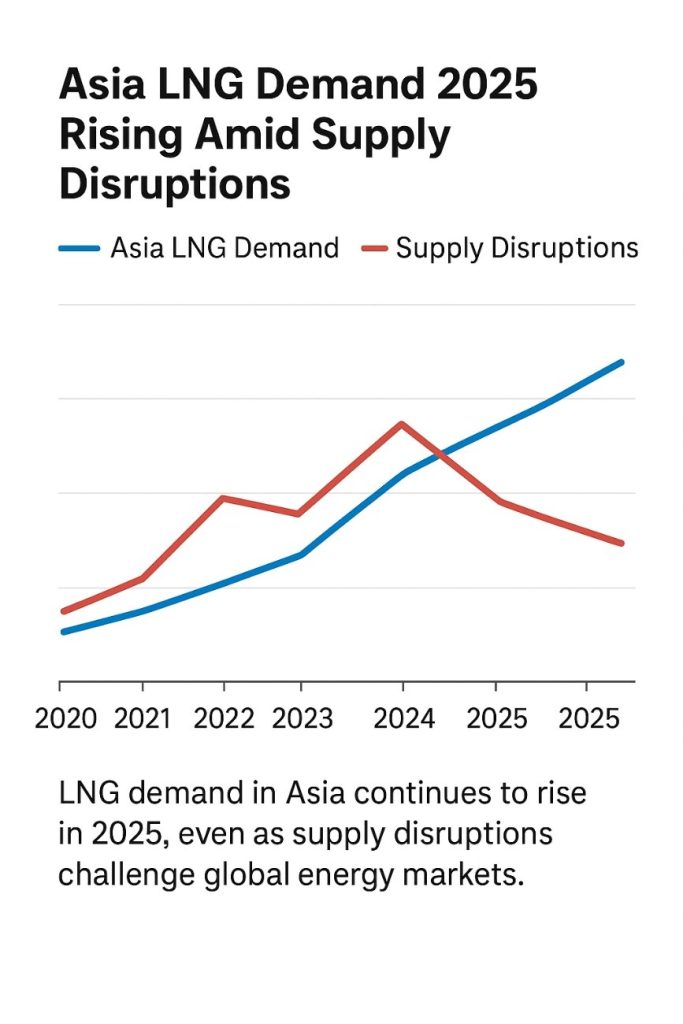

Asia LNG demand 2025 remains strong due to population growth and industrial demand. Japan, India, and China rely on LNG imports to balance energy diversification Asia-Pacific goals with coal reduction. LNG supply disruption Qatar threatens these plans. Contract security is vital, yet Qatar LNG contracts 2025 face uncertainty if strikes drag on. LNG import risk Japan India China remains high, and LNG price volatility Asia is expected to intensify.

Key Market Reactions to the Qatar Strike

LNG Price Volatility and Contract Disruptions

LNG supply disruption Qatar has led to short-term price spikes. Traders factor in delays at liquefaction facilities and shipping bottlenecks. Spot markets in Singapore and Tokyo saw increased premiums. Asia LNG demand 2025 collides with limited supply, making long-term Qatar LNG contracts 2025 more valuable. Buyers push for clauses covering force majeure and delivery delays.

In our earlier analysis on how markets reacted to the Qatar strike, with Gulf stocks slipping while gold and oil prices rose, we highlighted the immediate financial impact. You can read that full breakdown here Market Reacts to Qatar Strike: Gulf Stocks Slip, Gold and Oil Rise

Oil Market Shifts and Risk Premiums

Middle East energy volatility also lifted oil prices. Investors priced in a risk premium linked to Strait of Hormuz transit. Gulf energy exports 2025 face possible rerouting, adding costs. The Ukraine war gas impact already tightened European energy balances, and combined with Qatar disruptions, it raises global energy security 2025 risks. Oil traders hedge with storage and diversified supply sources.

Investor Moves Into Safe Havens

Energy shocks push investors toward gold, US Treasuries, and defensive equities. Commodities as hedge assets gain traction in portfolios. Oil and gas equity opportunities in North America look attractive due to supply reliability. LNG infrastructure investment Asia also becomes a focus for long-term funds seeking stability.

Asia’s Energy Security Strategies in 2025

Japan’s LNG Import Challenges

Japan LNG security policy 2025 focuses on contract renegotiation and fuel diversification. Strikes in Qatar highlight exposure. LNG import risk Japan India China shows Tokyo as most vulnerable due to lack of domestic production.

Japan invests in renewables but remains dependent on LNG. Its oil and gas strategy Asia includes nuclear restarts, though public resistance limits progress.

China’s Diversification Strategy

China LNG demand growth 2025 continues despite slowing economy. To reduce exposure, Beijing expands pipeline imports from Russia and Central Asia. LNG supply disruption Qatar reinforces this diversification push. China also secures equity stakes in overseas LNG projects to balance risks. Energy diversification Asia-Pacific discussions often center on China’s scale, as it shapes global LNG shipping routes Asia.

India’s Growing LNG Dependence

India LNG import strategy 2025 faces rising demand for power and fertilizer production. The Qatar strike energy security challenge underlines India’s import dependence. LNG infrastructure investment Asia includes new terminals on India’s east and west coasts. However, price volatility limits affordability. Policymakers weigh subsidies against fiscal pressures.

Middle East Energy Exports Under Pressure

Qatar’s LNG Export Commitments

Qatar LNG exports to Asia form a cornerstone of the global LNG market. Strikes delay shipments, testing the credibility of Qatar LNG contracts 2025. Buyers demand clearer penalties for supply disruption. LNG supply disruption Qatar undermines confidence in long-term deals that previously anchored energy stability.

Gulf Energy Infrastructure Risks

Middle East energy markets face rising costs for security. LNG shipping insurance costs increase as Gulf infrastructure comes under threat. Strait of Hormuz risk premium stays elevated. Global energy security 2025 depends heavily on stability across Gulf terminals, pipelines, and export facilities.

OPEC+ Policy Uncertainty

OPEC+ policy uncertainty compounds market risk. Saudi Arabia and UAE try to balance output cuts with revenue needs. Combined with Qatar disruptions, oil and gas strategy Asia must account for unpredictable Gulf production policies. This raises energy diversification Asia-Pacific urgency.

Investment Implications of Energy Security Risks

LNG Infrastructure and Terminal Investments

LNG infrastructure investment Asia accelerates as governments push for import capacity. Japan, India, and China add regasification terminals. Singapore positions as a hub for trading and storage. Global investors see these projects as strategic, even with energy transition slowdown 2025 debates ongoing.

Oil and Gas Equity Opportunities

Oil and gas equity opportunities in 2025 focus on reliable producers outside conflict zones. North American shale and Australian LNG offer diversification. Gulf LNG investment strategies remain attractive long term, but short-term volatility deters some funds.

Commodities as Hedge Assets

Commodities as hedge assets remain central in 2025 portfolios. Gold, LNG futures, and crude contracts offer insurance against Qatar strike energy security risks. Wealth managers use diversified baskets to reduce exposure to sudden shocks.

Risks and Contradictions in Energy Markets

Oversupply Versus Security Fears

Energy markets face contradiction. On one hand, LNG capacity expansions create oversupply risk. On the other, strikes and war disrupt flows, making buyers pay premiums. Asia LNG market outlook 2025 reflects this tension between supply growth and delivery uncertainty.

Energy Transition and Fossil Fuel Dependence

Energy transition slowdown 2025 is visible as governments prioritize security over emissions goals. LNG and oil remain central despite climate pledges. Investors balance green funds with fossil exposure. This contradiction shapes oil and gas investment 2025 strategies.

Political and Regulatory Uncertainty

Political and regulatory uncertainty adds to investor caution. From sanctions on Russia to Gulf labor disputes, risks multiply. LNG shipping routes Asia require contingency planning. Energy security frameworks lag behind geopolitical realities.

Regional Perspectives on Qatar Strike Energy Security

USA and UK: Investor Caution on Commodities

US and UK investors show caution. They track oil and gas equity opportunities but hedge portfolios with safer assets. The Qatar strike energy security risk drives focus on diversified energy holdings.

France and EU: LNG Diversification Push

France and the EU accelerate LNG diversification away from Russia and Qatar. They secure contracts from Africa and the US. Ukraine war energy impact makes European policymakers prioritize storage and flexible supply options.

UAE and Saudi Arabia: Direct Export Pressures

The UAE and Saudi Arabia face pressure as Middle East energy volatility rises. They attempt to project stability through capacity investments. However, OPEC+ policy uncertainty complicates messaging. Gulf energy exports 2025 remain under scrutiny.

Asia-Pacific: Balancing Growth and Energy Risk

Asia-Pacific economies juggle growth with energy security risk. LNG import risk Japan India China remains acute. Energy diversification Asia-Pacific includes nuclear, renewables, and regional pipelines. Yet LNG supply disruption Qatar keeps short-term anxiety high.

Strategies for Policymakers and Investors

Strengthening Energy Security Frameworks

Governments must build frameworks that account for geopolitical shocks. Energy security plans require supply diversification and better storage. Investors look for clarity to reduce volatility.

Diversification Across Energy Sources

Diversification across energy sources is the only path to reduce dependency. Countries expand nuclear, hydro, solar, and hydrogen, even during energy transition slowdown 2025. Oil and gas strategy Asia still dominates, but diversification builds resilience.

Preparing for Geopolitical Shocks

Investors and policymakers must prepare for geopolitical shocks. The Qatar strike energy security crisis highlights the cost of complacency. Scenario planning, insurance, and flexible contracts become essential.

FAQs on Qatar Strike Energy Security

How does the Qatar strike affect Asia’s LNG imports?

It disrupts shipments, raises spot prices, and pressures long-term Qatar LNG contracts 2025. Asia LNG demand 2025 makes the region highly exposed.

What role does Ukraine war play in energy security?

The Ukraine war gas impact shifted LNG toward Europe, creating tighter competition in Asia. Combined with Qatar disruptions, it raised global energy security 2025 risks.

How should investors respond to energy shocks?

Investors focus on commodities as hedge assets, oil and gas equity opportunities, and LNG infrastructure investment Asia. Diversification reduces exposure.

Which countries are most exposed to LNG risk?

Japan, India, and China face the highest LNG import risk. Qatar strike energy security issues threaten their supply stability.

Conclusion: Positioning for Energy Security in an Unstable World

The Qatar strike energy security crisis, compounded by the Ukraine war, reshapes Asia’s oil and gas strategy. LNG supply disruption Qatar exposes vulnerabilities in Japan, China, and India. Investors face volatility but also see opportunities in infrastructure and commodities.

Policymakers must balance energy transition slowdown 2025 with the urgency of security. Global energy security 2025 depends on resilience, diversification, and readiness. This article is for educational purposes only, not financial advice.

1 thought on “Qatar Strike Energy Security and Ukraine War Shape Asia in 2025”