Why Apple Loses Billions Matters to Investors

Apple loses billions in market value after the release of the iPhone 17 Pro Max, sending shockwaves across global equity markets. Investors from the USA to Asia watch closely as Apple stock slides under pressure. This decline impacts not only Apple’s market capitalization but also confidence in broader tech stocks. For finance professionals, wealth managers, and policymakers, understanding the risks behind this shift is critical. The launch has triggered sharp reactions, raising questions about Apple’s earnings trajectory, investor sentiment, and sector-wide implications in 2025.

Understanding the Apple Market Value Drop

iPhone 17 Pro Max Launch and Investor Reaction

The iPhone 17 Pro Max was expected to drive a new wave of sales. Instead, muted consumer demand and high pricing created disappointment. Analysts cited supply chain constraints, weaker adoption in China, and competitive pressures in India and Southeast Asia. The result was an immediate Apple market value drop as investors recalibrated revenue forecasts. Apple stock slides reflect concerns over profit margins and product innovation risks, two key factors in investor confidence.

Apple Stock Slides and Market Capitalization Loss

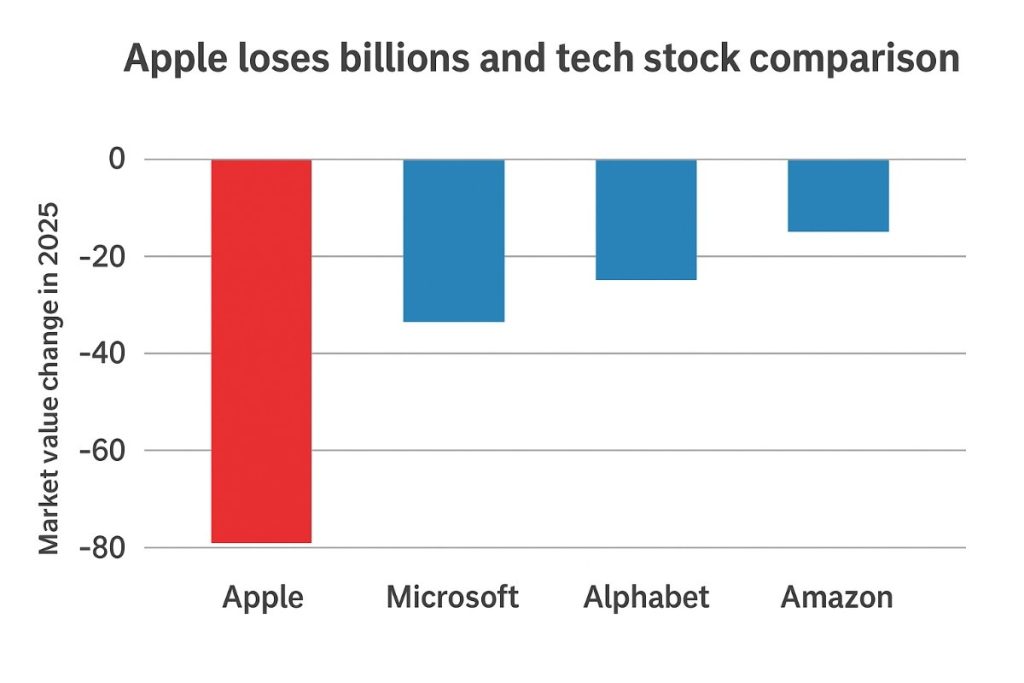

Following the launch, Apple’s market capitalization loss surpassed 150 billion dollars within days. This sharp decline put Apple under pressure in both New York and London markets. Hedge funds, retail investors, and pension funds experienced portfolio erosion. Wall Street reaction to Apple was swift, with analysts cutting price targets and warning about Apple earnings impact for upcoming quarters. The scale of the Apple market value drop shows how quickly sentiment can shift around a single product cycle.

Wall Street Confidence and Portfolio Risks

Investor confidence in Apple weakened as research reports flagged risks to profit margins and international sales. For institutional investors, the Apple stock slide meant heavier portfolio exposure to volatility. Mutual funds and ETFs holding Apple saw declines, while wealth managers faced pressure to explain the risks to clients. Portfolio risk management became essential, as Apple’s weight in global indexes magnified the effect of its market value decline.

Apple Loses Billions and Market Reactions

Stock Volatility After iPhone 17 Pro Max

Apple stock volatility spiked immediately after the iPhone 17 Pro Max launch fail. Trading volumes surged as investors rushed to cut exposure.

The heightened swings highlighted how sensitive Apple shares remain to product demand signals. Market makers adjusted risk models, and derivatives traders saw increased premiums on Apple options.

Sector-by-Sector Impact of Apple Stock Slides

The Apple market value drop affected related sectors. Semiconductor firms tied to Apple’s supply chain fell as earnings expectations softened. Consumer electronics peers faced sentiment pressure. Software firms linked to Apple’s ecosystem also saw valuation dips. The shock extended beyond Apple stock, amplifying concerns about the stability of tech indices like Nasdaq.

Safe Haven Shifts Away from Apple Shares

Traditionally, Apple has acted as a safe haven within tech portfolios. With Apple stock under pressure, investors shifted capital into defensive sectors like healthcare and utilities. Sovereign wealth funds from the Middle East diversified away from Apple to limit losses. This safe haven shift reflected broader skepticism about whether Apple could maintain growth momentum in 2025.

Regional Investor Trends in 2025

USA and UK: Apple Stock Pressure and Portfolio Losses

In the USA, Apple stock slides led to broad market pullbacks, given its heavy weight in the S&P 500 and Nasdaq. UK investors mirrored these concerns as funds with Apple exposure saw asset value declines. Pension portfolios in both regions reported short-term losses. Market analysts warned of continued risks if Apple earnings impact proved deeper than expected.

UAE and Gulf: Apple Market Value Drop and Global Investors

The UAE and Gulf markets, home to large sovereign wealth funds, faced ripple effects. Apple losing billions forced portfolio rebalancing. Gulf investors, holding substantial stakes in US equities, reassessed their tech stock allocations. The Apple market capitalization loss added caution to regional investment strategies focused on diversification.

Europe and France: Apple Tech Stock Sentiment

European investors, especially in France, reacted with skepticism toward Apple’s product strategy. French analysts highlighted the iPhone 17 launch fail as evidence of declining innovation. Apple’s market value drop reinforced concerns about overexposure to US tech stocks in European funds. Regulators in Europe also flagged risks tied to market concentration in big tech equities.

Asia-Pacific: iPhone 17 Pro Max Impact on Investor Confidence

Asia-Pacific markets, including Japan, India, and China, felt direct impacts. Japanese funds trimmed Apple holdings as the stock slid. Indian investors, initially bullish on Apple’s local market expansion, saw sentiment shift after disappointing iPhone 17 sales. In China, geopolitical tensions combined with the iPhone 17 Pro Max impact to accelerate Apple stock volatility.

Corporate and Strategic Implications for Apple

Apple Revenue Slowdown and Earnings Impact

Apple’s revenue slowdown became visible after the iPhone 17 Pro Max launch fail. Analysts downgraded quarterly earnings expectations. The Apple earnings impact raised questions about the company’s ability to sustain growth in mature markets. Revenue concentration in hardware sales intensified these concerns.

Supply Chain and Product Risks

Apple’s supply chain risks added pressure. Component shortages, rising costs in Southeast Asia, and limited production capacity in India undermined profitability. The product risks highlighted the vulnerabilities of Apple’s global manufacturing strategy. Investors noted these risks as contributors to Apple losing billions in market value.

Apple Market Strategy and Investor Expectations

Apple’s market strategy faced scrutiny from investors expecting diversification into new services or AI-driven products. The iPhone 17 Pro Max impact underscored the risks of overdependence on one flagship product. Investor expectations now center on whether Apple can deliver revenue streams that reduce reliance on the iPhone cycle.

Investment Implications of Apple Losing Billions

Risks for Equity Investors in 2025

Equity investors holding Apple shares faced immediate valuation losses. The Apple market value drop amplified portfolio risks, especially for those overweight in tech. In 2025, investors must assess equity exposure carefully, as Apple stock volatility threatens long-term portfolio stability.

Portfolio Diversification Beyond Apple Stock

The Apple stock slides reinforced the importance of diversification. Wealth managers advised clients to spread investments across sectors less dependent on cyclical consumer electronics. Defensive allocations to bonds, real estate, and infrastructure became more attractive as Apple stock remained under pressure.

Opportunities in Defensive and Non-Tech Sectors

Investors searching for stability shifted capital into sectors such as energy, consumer staples, and financials. The Apple loses billions episode highlighted opportunities to hedge against volatility by balancing growth and defensive assets. This realignment reflects a cautious stance by global investors in 2025.

Risks and Contradictions in Apple’s Market Outlook

Apple Stock Slides vs Global Tech Growth

While Apple stock slides, other tech firms continue to show resilience. Investors face the contradiction of strong AI and semiconductor growth alongside Apple’s earnings slowdown. This divergence forces careful stock selection within the broader tech sector.

Regulatory and Political Risks for Apple

Regulatory scrutiny in the USA and Europe adds risks to Apple’s outlook. Antitrust investigations, data privacy rules, and tax debates weigh on investor sentiment. Political tensions with China also raise uncertainty for Apple’s supply chain and market access.

Currency, Tariff, and Supply Chain Issues

Currency fluctuations and tariffs on imports affect Apple’s profitability in Europe and Asia. Rising production costs in emerging markets compound these challenges. Supply chain issues remain a core risk as Apple manages global operations.

Regional Perspectives on Apple Loses Billions

USA: Apple Stock and Investor Portfolios

In the USA, Apple losing billions directly hurt investor portfolios. Large asset managers cut forecasts for Apple’s contribution to index performance. Financial advisors reported client concerns over concentrated exposure to Apple stock.

UK and EU: Apple Market Capitalization Decline

UK and EU investors emphasized the scale of Apple’s market capitalization decline. Asset managers reduced Apple weighting in European-focused funds. The sentiment highlighted a structural reevaluation of tech exposure in global portfolios.

UAE and Middle East: Apple Global Investor Exposure

The UAE and Middle East investors with global exposure reduced Apple positions to protect against further losses. Sovereign wealth funds stressed diversification as the primary defense against Apple’s stock volatility.

Asia: Apple iPhone 17 Pro Max Sentiment and Stock Risks

Asian markets reflected disappointment in iPhone 17 Pro Max performance. Chinese and Japanese investors in particular cited weakening brand momentum. This sentiment added further pressure on Apple shares across Asia-Pacific exchanges.

Strategies for Policymakers and Investors Tracking Apple

Monitoring Tech Stock Volatility and Apple Risks

Policymakers and investors now monitor Apple’s volatility as an indicator of broader tech stock risks. Apple losing billions serves as a case study in the fragility of market sentiment.

Portfolio Rebalancing and Defensive Plays

Institutional investors focus on portfolio rebalancing. Defensive plays in bonds, infrastructure, and dividend-focused equities help reduce the weight of Apple stock slides in overall performance.

Preparing for Apple Earnings Shocks

Investors prepare for earnings shocks by setting tighter risk controls and adjusting asset allocations. Anticipating volatility around Apple earnings releases becomes essential.

FAQs on Apple Loses Billions After iPhone 17 Pro Max Launch

Why did Apple lose billions in market value?

Apple lost billions because of weak iPhone 17 Pro Max demand, higher production costs, and investor concerns about profit margins.

How did the iPhone 17 Pro Max impact Apple stock slides?

The iPhone 17 Pro Max failed to meet sales expectations, leading to lower revenue forecasts and a significant stock decline.

Which investors are most exposed to Apple market value drop?

Institutional funds, ETFs, and pension portfolios with large Apple weightings face the highest exposure.

What portfolio strategies help reduce Apple stock risks?

Diversification into defensive assets and reducing reliance on single tech stocks help limit risk.

Conclusion: Positioning for Apple Market Value Risks in 2025

Apple loses billions after the iPhone 17 Pro Max launch, reshaping investor strategies in 2025. From the USA to Asia, the Apple market value drop has forced reassessment of equity exposure and portfolio balance. For policymakers, Apple’s decline highlights systemic risks tied to tech concentration.

Investors now weigh diversification, defensive sectors, and risk controls more heavily. Educational purposes only, not financial advice.