Why AI Regulation in Finance Matters in 2025

AI regulation in finance is no longer a distant concern. In 2025, regulators worldwide are building new frameworks to govern how AI operates in banking, payments, trading, and investment services. Financial AI regulation affects how institutions manage compliance, protect consumers, and control systemic risks. As a result, global AI regulation finance has become a defining theme for investors, fintech firms, and policymakers. AI rules 2025 are reshaping market practices and influencing where capital flows. Understanding these changes helps you prepare for both risks and opportunities.

Understanding AI Regulation in Financial Services

What Is AI Regulation in Finance

AI regulation in finance refers to legal and compliance standards that govern how banks, fintechs, and asset managers use artificial intelligence. These frameworks target areas such as AI transparency in finance, algorithmic accountability, and explainable AI in financial services. Regulators are focused on preventing systemic risk from AI in finance while promoting innovation. Therefore, financial AI regulation in 2025 is both an enabler and a constraint.

Why 2025 Is a Turning Point

The year 2025 marks a shift because AI adoption in financial services has accelerated. Fintech AI compliance is now essential for licensing and market participation. AI governance in finance is no longer optional. In addition, AI rules for investment firms in 2025 set strict obligations on robo advisors and algorithmic traders. Consequently, the industry faces new compliance costs, but also fresh chances to build trust.

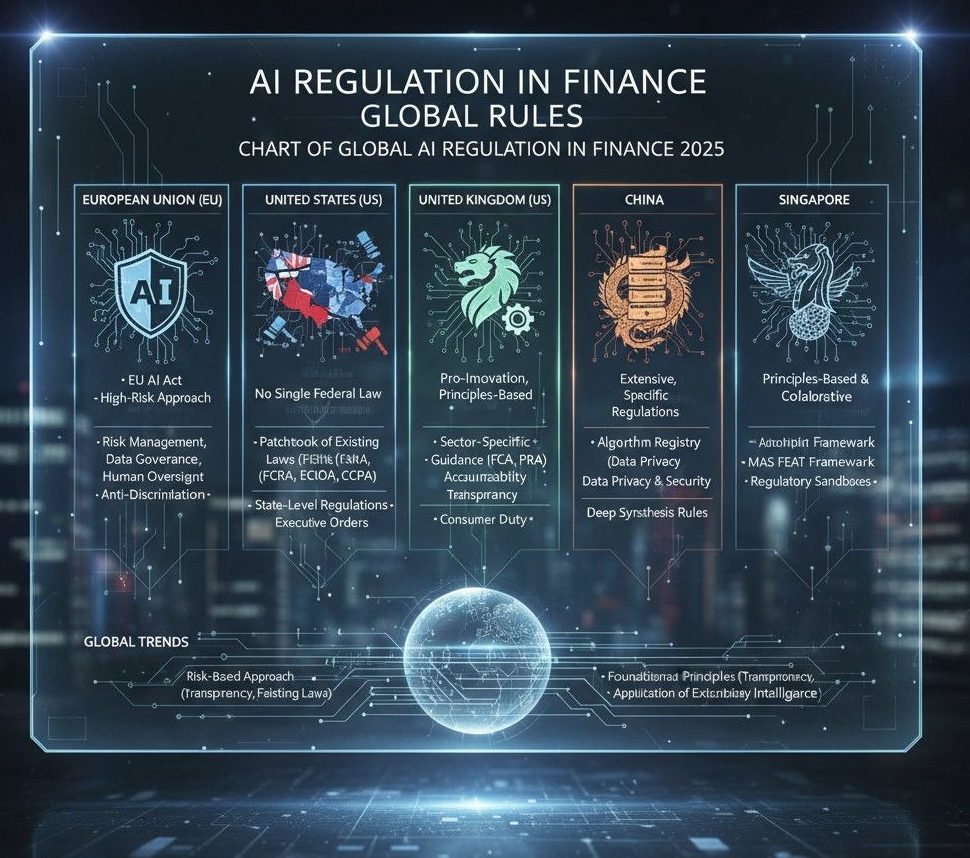

Global AI Regulation Landscape

USA: Financial AI Oversight and SEC Priorities

In the USA, financial regulators and AI oversight are converging. The SEC is evaluating AI-driven trading oversight and systemic risks from algorithmic decision making.

AI regulation in US financial markets requires firms to disclose AI model governance practices. Because of this, compliance technology (RegTech) is gaining importance.

EU: AI Act and Banking Compliance Rules

The EU AI Act introduces binding rules for banks and asset managers. EU AI Act and banking rules classify financial AI applications as high-risk. Accordingly, explainable AI is required for credit scoring and robo advisor regulation 2025. Firms that fail to meet transparency standards risk penalties.

UK and Asia: Emerging Regulatory Frameworks

The UK has issued guidance on AI ethics in finance, while Singapore AI compliance in banking sets global benchmarks for responsible AI adoption. Similarly, Japan financial AI regulation focuses on model testing and supervisory technology (SupTech). These frameworks reflect a trend of global standards for AI in banking.

China, India, and UAE: Localized AI Finance Policies

China AI regulation in fintech prioritizes state oversight of data and algorithms. India AI policy in finance emphasizes investor protection and algorithmic accountability. UAE AI governance finance is linked to its fintech hub growth. Together, these jurisdictions highlight international coordination on AI finance rules, although approaches differ.

AI in Banking and Investment Oversight

AI Compliance in Banking and Payments

Banks rely on AI for credit scoring, fraud detection, and payments automation. AI compliance in banking ensures these models remain transparent. Because regulators demand explainability, firms must adopt AI model governance practices.

Robo Advisor Regulation 2025

Robo advisor regulation 2025 is critical since these platforms manage trillions globally. AI regulation banking sector rules now require disclosures on portfolio strategies under AI regulation. Thus, investors gain more clarity about risks.

AI-Driven Trading Oversight

AI-driven trading oversight targets algorithmic systems that could destabilize markets. Regulators worry about systemic risk from AI in finance when models amplify volatility. Consequently, stress testing AI models is a regulatory priority.

Risks and Systemic Challenges of AI in Finance

Algorithmic Accountability and Transparency Issues

AI transparency in finance remains a challenge. Hidden biases and errors create investor exposure. Therefore, algorithmic accountability and explainable AI in financial services are now mandatory compliance areas.

Systemic Risk from AI in Finance

Systemic risk from AI in finance arises when multiple firms rely on similar models. Market contagion can spread quickly if algorithms react to shocks in the same way. As a result, regulators stress continuous monitoring.

Hidden Bias, Model Risk, and Investor Exposure

Model risk and hidden bias affect investor portfolios. Because AI regulation for investors addresses these vulnerabilities, ethical AI investment strategies are gaining importance.

AI Regulation and Market Stability

Protecting Global Financial Stability

Financial AI regulation aims to safeguard stability. By setting standards for algorithmic accountability, regulators reduce contagion risk. Consequently, AI regulation in finance supports confidence.

Reducing Market Manipulation Risks

AI-driven trading oversight reduces manipulation risks such as spoofing or unfair advantage. Accordingly, AI rules 2025 introduce transparency mandates that protect investors.

Building Investor Trust Through Regulation

Investor trust depends on clear rules. Therefore, global AI regulation finance frameworks improve market participation. Investors can allocate capital knowing oversight exists.

Technology, Ethics, and Compliance in 2025

AI Ethics in Finance

AI ethics in finance deals with fairness and accountability. In 2025, regulators require banks and fintechs to prove they follow ethical AI investment strategies.

Explainable AI and Model Governance

Explainable AI is no longer optional. AI model governance frameworks enforce transparency in credit decisions, trading, and robo advisor portfolios. Consequently, firms must adapt their technology stack.

RegTech and SupTech as Compliance Solutions

Compliance technology (RegTech) and supervisory technology (SupTech) are expanding. Because AI compliance in banking is complex, firms deploy tools that automate monitoring.

Investor and Market Implications

How AI Rules Impact Investors

AI regulation for investors changes portfolio strategies. Rules affect exposure to fintech stocks, banking shares, and AI technology firms. As a result, investors must evaluate compliance as a factor.

Portfolio Strategies Under AI Regulation

Portfolio strategies under AI regulation include diversification and defensive allocations. Consequently, investors seek safe assets when AI oversight raises compliance costs.

Opportunities in Compliance Technology

Compliance challenges for AI in fintech 2025 create growth for RegTech. Accordingly, investors view compliance technology firms as opportunities.

Contradictions and Global Outlook

Innovation vs Oversight in Financial AI

Balancing regulation and growth is difficult. While AI regulation in finance protects stability, it may slow fintech innovation. Yet, oversight prevents costly failures.

International Coordination on AI Finance Rules

Cross-border AI regulation coordination is limited. Because of fragmented rules, global firms face compliance complexity. International bodies push for harmonization.

Balancing Regulation and Growth

Policymakers aim to balance growth with risk control. Although oversight is strong, innovation continues in areas like AI risk management finance.

Strategies for Policymakers and Investors

Monitoring AI Risks in 2025

Monitoring AI risks ensures systemic stability. Regulators demand regular audits of AI models. Similarly, investors track compliance reports before allocating capital.

Stress Testing AI Models and Portfolios

Stress testing AI models is a regulatory requirement. Therefore, institutions run simulations on trading systems and robo advisors. Investors also stress test portfolios against AI-driven shocks.

Investor Strategies for Regulated AI Markets

Investor strategies under AI regulation include diversification, ethical AI investment strategies, and exposure to RegTech. Accordingly, portfolios reflect both risk control and opportunity.

FAQs on AI Regulation in Finance 2025

What is AI regulation in finance?

AI regulation in finance is a set of rules that govern how financial institutions use artificial intelligence.

Why is AI compliance critical for banks and investors?

AI compliance in banking and fintech ensures fairness, transparency, and reduces systemic risk from AI in finance.

Which regions lead in AI financial regulation?

EU AI Act and banking rules are most advanced, while the USA and Asia are building parallel frameworks.

How will AI rules affect investors in 2025?

AI rules 2025 affect fintech valuations, compliance costs, and investor portfolio strategies under AI regulation.

Conclusion: How Global AI Regulation Will Reshape Finance in 2025

AI regulation in finance in 2025 defines how banks, fintechs, and investors operate. Global AI regulation finance frameworks reduce systemic risks, build investor trust, and shape opportunities in compliance technology. Financial supervision of AI systems continues to evolve.

Regulators are moving quickly, therefore investors must stay alert. In addition, global standards are tightening, so compliance teams need to adapt early. As a result, firms that act now will reduce risk and capture opportunities.Overall, investors must align with new rules while seeking growth. Educational purposes only, not financial advice.