Why Aging Populations Are Reshaping Global Finance

The global pension crisis 2025 reflects a turning point for both markets and policymakers. Demographics are reshaping financial systems as older populations retire while birth rates remain weak. Fewer workers must support more retirees, which strains retirement finance 2025. The imbalance drives pension fund shortfalls and exposes risks in capital flows. Investors, governments, and institutions must now adapt to this shift or face severe pension solvency risks.

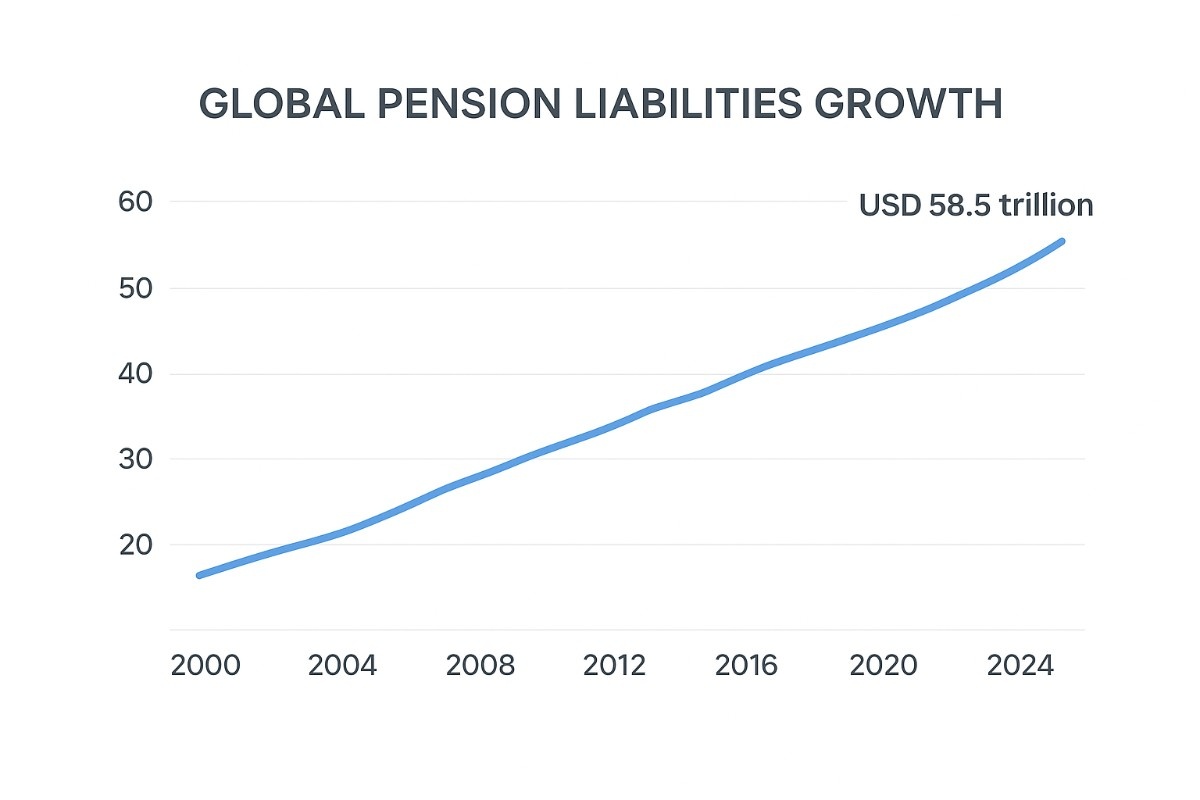

The Scale of the Retirement Savings Gap

The global retirement savings gap has grown to trillions of dollars. Studies show that by 2025, the world could face a pension fund shortfall of more than 400 trillion dollars by 2050 if reforms stall. The pension debt crisis is no longer an abstract concern but an immediate financial reality. Many households lack adequate retirement savings, which magnifies pressure on state-backed pension systems. Private and public pension liabilities rise faster than assets, creating risks of a pension system collapse.

Pension Fund Shortfalls Across Major Economies

Developed economies hold the largest pension liabilities. The US pension crisis 2025 highlights underfunded state pensions, where unfunded liabilities exceed several trillion dollars. In Europe, low yields erode the sustainability of defined benefit plans. Japan’s aging economy faces the world’s highest old-age dependency ratio, while China’s pension gap widens as its population shrinks. Emerging market pensions are smaller but face rapid strain as demographics shift. Together, these pressures define the global pension crisis 2025 as a systemic challenge to retirement finance.

Market Impacts of the Pension Crisis

Pension Funds and Equities Exposure

Pension funds remain some of the largest institutional investors in equities. In the US alone, they hold more than 20 percent of listed shares. The pension fund shortfall forces managers to chase higher returns to cover future obligations. This increases exposure to stock market volatility.

Market downturns, like those seen in 2020 and 2022, amplify pension solvency risks and widen the retirement savings gap. The link between pension fund investments and equities strengthens the global market impact of the pension crisis.

Bonds, Yields, and Pension Liabilities

Bonds have historically been the backbone of pension portfolios. Yet, ultra-low yields and rising interest rate volatility disrupt traditional strategies. Pension liabilities rise when yields fall, worsening the pension debt crisis. In Europe and Japan, long periods of negative interest rates have magnified deficits. The global pension crisis 2025 reveals how bonds and pension crisis dynamics intertwine, creating structural challenges. A shift toward higher-yielding instruments increases pension fund risks 2025, exposing investors to credit and liquidity pressures.

Alternative Assets and Private Credit Growth

The funding gap pushes pension funds into alternatives. Private credit, infrastructure, and real estate attract capital as institutions diversify. Pension funds real estate allocations now exceed 10 percent in several countries. Private credit and pensions have become linked as funds search for yield outside public markets. These strategies improve returns but add complexity and illiquidity risks. The global pension crisis 2025 has accelerated the growth of alternative investments retirement strategies, which reshape capital allocation worldwide.

Regional Perspectives on the Pension Crisis

US Pension Crisis 2025 and Market Risks

The US pension crisis 2025 reflects decades of underfunding. State and municipal pension systems remain exposed, while corporate plans shift from defined benefit to defined contribution. Pension fund risks 2025 threaten fiscal stability, as tax revenues struggle to meet obligations. The solvency gap affects both local governments and markets, increasing the risk of a pension debt bubble. Retirement finance 2025 in the US will depend on reforms, higher contributions, and potentially federal support.

European Pensions Under Pressure

Europe’s demographic decline combines with low yields to pressure pensions. Many systems depend heavily on pay-as-you-go structures, which rely on shrinking workforces. The European pensions under pressure narrative includes Germany, Italy, and France, where protests against retirement age reforms highlight political challenges. Defined benefit obligations create pension fund shortfalls, while investment strategies shift toward alternatives. European pension solvency risks add to volatility in global capital flows.

Japan and China’s Aging Economies

Japan represents the most advanced case of demographics and finance interaction. Its old-age dependency ratio is projected to exceed 50 percent by 2050. The country’s pension fund, the GPIF, is the largest in the world and heavily invested in global equities and bonds. Japan aging economy pensions highlight how demographic shifts influence global markets. China faces a growing pension gap as its workforce shrinks and longevity rises. Emerging market pensions in Asia will increasingly affect cross-border capital flows.

Policy Shifts and Pension Reform

How Governments Are Responding to Shortfalls

Governments face rising pressure to reform. Responses include increasing retirement ages, raising contribution rates, and shifting from defined benefit to defined contribution systems. Some countries pursue partial privatization of pensions to reduce liabilities. Pension reform global markets impact investment flows as systems shift allocations. Yet political resistance remains high. Without sustained reforms, the pension debt crisis risks escalating into a broader financial shock.

Sovereign Wealth Funds and Retirement Finance

Sovereign wealth funds play a growing role in pension reform. Some governments channel excess revenues into funds designed to stabilize retirement systems. For example, Norway’s Government Pension Fund Global and Singapore’s GIC act as stabilizers. Sovereign wealth and pensions highlight how resource-rich countries hedge future obligations. Their global capital flows pensions strategies affect equity, bond, and real estate markets worldwide. The global pension crisis 2025 strengthens the importance of sovereign wealth in long-term retirement finance.

Global Capital Flows Driven by Demographics

Demographics are reshaping cross-border capital flows. Aging populations in developed economies shift assets from growth to income investments. Pension systems allocate more into bonds and alternatives abroad, driving liquidity in global markets. Emerging markets attract pension capital into infrastructure and private credit. The global pension crisis 2025 creates feedback loops, where demographics and finance drive flows that reinforce pension fund risks 2025.

Investor Strategies Amid the Crisis

Retirement Investment Strategies in 2025

Investors adapt by diversifying portfolios and balancing growth with stability. Retirement investment strategies include equities for growth, bonds for stability, and alternatives for yield. Pension sustainability 2025 depends on disciplined allocation and risk management. Fund managers must prepare for volatility while ensuring solvency. The future of pensions will be shaped by these investment strategies as demographic pressures mount.

Private Credit, Real Estate, and Alternatives

Private credit and pensions continue to align as funds seek steady cash flows. Real estate allocations increase, particularly in logistics, housing, and healthcare sectors linked to aging populations. Alternative investments retirement strategies offer higher returns but require robust governance. Pension funds equities remain vital, yet illiquid alternatives now carry greater weight. The global pension crisis 2025 accelerates these trends, making diversification essential for pension fund solvency.

Long-Term Opportunities in Aging Societies

Aging populations also create opportunities. Healthcare, biotechnology, senior housing, and financial planning services will expand. Pension funds real estate tied to healthcare infrastructure can provide stable income. Long-term investors can benefit from demographic trends while managing pension fund risks 2025. The future of pensions is not only about liabilities but also about capturing growth linked to an aging society.

Outlook for Global Pension Systems

Future of Pensions and Market Stability

The global pension outlook 2025 depends on reform, investment, and demographics. Stability requires stronger funding ratios, disciplined investment strategies, and structural adjustments. Pension system collapse fears arise when liabilities overwhelm assets, yet reforms can stabilize solvency. The future of pensions will shape capital markets for decades, influencing both equities and fixed income allocations.

Risks of a Pension Debt Bubble

The pension debt crisis poses systemic risks. Unfunded liabilities resemble a pension debt bubble that threatens fiscal and market stability. If growth slows or markets correct, pension fund shortfalls could worsen. Pension solvency risks may trigger fiscal crises, particularly in regions with high public debt. The global pension crisis 2025 highlights how debt dynamics and demographics converge to shape market risks.

Positioning Portfolios for 2030 and Beyond

Investors looking toward 2030 must consider demographics, policy, and market structure. Positioning portfolios requires balancing equities, fixed income, and alternatives. Pension funds stock market impact will remain significant, yet diversification is essential. Private credit, infrastructure, and global real estate will grow as allocations. Long-term strategies must anticipate demographic pressures while maintaining resilience.

Common Questions About the Global Pension Crisis 2025

What is driving the pension fund shortfall?

The pension fund shortfall stems from aging populations, low yields, and inadequate savings. Demographics reduce the ratio of workers to retirees, while investment returns fail to keep pace with liabilities.

Which regions face the highest risks?

The US, Europe, Japan, and China face the largest shortfalls. Emerging market pensions also risk strain as populations age, though on a smaller scale.

How are pensions impacting global markets?

Pensions drive capital flows into equities, bonds, and alternatives. Pension funds equities holdings shape stock markets, while sovereign wealth and pensions affect global liquidity.

What strategies can investors adopt?

Diversification, disciplined risk management, and exposure to growth sectors linked to aging populations are key. Alternatives like private credit and healthcare real estate offer opportunities.

Final Thoughts: Global Pension Crisis 2025 and Capital Flows

The global pension crisis 2025 represents one of the defining challenges for markets and policymakers. Aging populations reshape finance, force pension reforms, and redirect capital flows worldwide. Investors must adapt strategies to manage risks while capturing opportunities in an aging world. Pension sustainability 2025 depends on reform, resilience, and innovation. Educational purposes only, not financial advice.