Global Debt 2025 in Focus

Global debt 2025 has reached record highs. According to the International Monetary Fund, total global debt now exceeds 315 trillion dollars. Governments, corporations, and households continue to borrow heavily. Rising borrowing costs are creating new pressures across global markets.

The debt bubble 2025 is not just about size. It is about fragility. Higher interest rates, slowing growth, and persistent inflation are squeezing both public and private balance sheets. Investors are starting to question whether the world can sustain this level of leverage without triggering the next financial crisis.

Why Global Debt Has Reached Record Levels

Over the past decade, central banks kept interest rates near zero. Cheap credit encouraged governments and corporations to expand debt-financed spending. The pandemic response in 2020 added trillions to sovereign debt. Fiscal stimulus and bond issuance reached levels unseen in modern times.

Now, interest rates have normalized. Servicing this debt is far more expensive. Global borrowing costs have risen by nearly 40 percent since 2022. The result is a structural shift in how economies allocate capital and manage deficits.

Rising Borrowing Costs and Economic Pressures

Global borrowing costs are pressuring both developed and emerging markets. In the United States, higher yields on Treasury bonds have increased government interest payments by more than 35 percent since 2021.

The Eurozone faces renewed stress as Italy and France see rising deficits. Emerging economies like Brazil, Turkey, and South Africa are feeling liquidity strain.

Household debt levels are also climbing. Rising mortgage rates and credit costs are limiting consumption. Corporate debt refinancing is becoming riskier. Many firms now face higher credit spreads, leading to delayed investments and weaker job creation.

How the Debt Bubble Threatens Market Stability

The global debt bubble 2025 threatens market stability through several channels. First, high leverage amplifies volatility. Small interest rate changes now trigger large valuation swings in bonds and equities. Second, fiscal tightening limits policy flexibility. Many governments can no longer rely on deficit spending to stimulate growth.

Third, a credit event in one major economy could spread quickly through global capital markets. The interconnected nature of today’s financial system increases contagion risk.

Market Impacts of the Global Debt Bubble 2025

Government Debt and Bond Market Stress

Government bond yields are rising as investors demand higher compensation for risk. In 2025, U.S. ten-year Treasury yields remain above four percent. Japan faces record costs for servicing its public debt. Eurozone countries with weaker fiscal positions are again under scrutiny.

This environment has reduced the value of long-duration bonds, hurting both institutional and retail investors. Pension funds and insurance companies, which hold large bond portfolios, are facing mark-to-market losses.

Corporate and Household Leverage Risks

Corporate leverage is at historical highs. Many companies borrowed heavily when rates were near zero. Refinancing at current levels strains profitability. Bank exposure to debt-sensitive sectors, such as real estate and manufacturing, is increasing.

Households are facing similar challenges. Rising mortgage and consumer loan rates are reducing disposable income. In several economies, credit defaults are trending higher. These dynamics weaken consumption and overall growth.

Liquidity Crunch and Investor Confidence

Liquidity crunches tend to appear late in debt cycles. As borrowing costs rise, investors become more cautious. Banks tighten lending standards. Access to credit weakens, leading to slower investment.

Investor confidence remains fragile. Market volatility 2025 reflects uncertainty about how central banks will balance inflation control with financial stability.

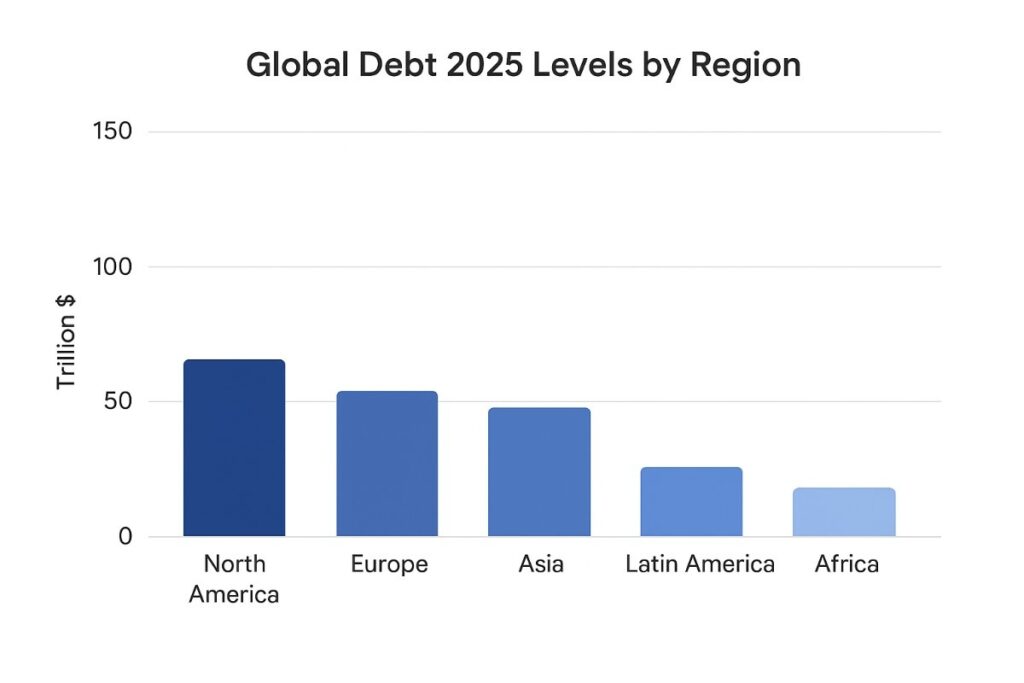

Regional Perspectives on Global Debt 2025

US Debt Ceiling and Fiscal Risks

The U.S. debt ceiling debate continues to create market uncertainty. The federal deficit has expanded, and Treasury issuance remains high. Investors worry that persistent borrowing could crowd out private capital and raise long-term rates.

China’s Local Government Debt Problem

China’s local government debt markets are under pressure. Infrastructure spending funded by off-balance-sheet borrowing has become unsustainable. Weak property sales have reduced fiscal revenue, raising default concerns.

Eurozone and Emerging Markets Vulnerabilities

The Eurozone faces structural debt risks. Nations with slower growth and high debt-to-GDP ratios are vulnerable to market shocks. Emerging markets with dollar-denominated debt are at higher risk as the U.S. dollar strengthens.

Central Banks and Global Borrowing Costs

Monetary Tightening and Interest Rate Shock

Central banks worldwide are trying to balance inflation control with debt sustainability. The U.S. Federal Reserve, European Central Bank, and Bank of England have kept rates elevated. This has caused an interest rate shock for highly leveraged sectors.

Inflation, Yields, and Debt Sustainability

Inflation remains stubborn in many economies. Higher yields have made debt refinancing more expensive. Governments now allocate more of their budgets to interest payments, limiting investment in infrastructure and social programs.

Global Coordination Challenges Among Policymakers

Global coordination is weakening. Each central bank follows domestic priorities, creating policy divergence. The lack of coordination increases exchange rate volatility and cross-border debt pressures.

Investor Strategies for the Debt Bubble 2025

Managing Fixed Income and Credit Exposure

Investors are reducing duration exposure and focusing on quality. Short-term government bonds and investment-grade credit remain preferred. Active management of fixed income portfolios has become essential to navigate volatility.

Safe Havens and Diversification Approaches

Gold, cash equivalents, and high-quality sovereign bonds are being used as safe havens. Diversification across currencies and asset classes helps mitigate systemic risk.

Tactical Opportunities in Volatile Markets

Periods of volatility also create opportunity. Distressed debt, selective emerging market bonds, and defensive equities can deliver returns if managed carefully. Investors must monitor liquidity and macro indicators closely.

Outlook for the Global Debt Crisis 2025

Debt Restructuring and Policy Reforms

Debt restructuring may become necessary for some sovereign and corporate borrowers. International institutions like the IMF are preparing contingency programs.

Structural reforms will be required to stabilize public finances.

Risks of Financial Contagion and Defaults

A key risk is financial contagion. A default in one major market could spread rapidly through global banking systems. Investors are already pricing higher credit default swap spreads as protection.

Preparing Portfolios for the Next Cycle

Portfolio protection 2025 focuses on resilience. Reducing leverage, maintaining liquidity, and diversifying across geographies are essential. Investors should remain defensive while seeking selective value opportunities.

Common Questions About Global Debt 2025

What is driving record global debt levels?

Decades of low interest rates, fiscal stimulus, and global crises encouraged excessive borrowing. Pandemic spending and ongoing policy support further expanded debt.

Which regions face the highest default risk?

Emerging markets with large external debt and limited reserves face the highest risk. Some developed economies, such as Italy and Japan, also remain vulnerable due to high public debt ratios.

How can rising rates trigger a crisis?

Higher rates increase debt servicing costs. If economic growth slows, borrowers may struggle to refinance. That combination can lead to defaults, asset price declines, and liquidity stress.

What can investors do to protect themselves?

Investors should maintain diversified portfolios, reduce exposure to speculative credit, and focus on quality assets. Monitoring global liquidity conditions and policy shifts is essential.

Final Thoughts: Global Debt 2025 and Market Resilience

The global debt 2025 challenge is a defining test for markets. High borrowing costs and record debt levels expose systemic weaknesses. Yet, financial systems have adapted before. Strong policy coordination, structural reform, and prudent investment management can reduce crisis risks.

The coming year will test how well economies can balance growth and debt. Vigilance, discipline, and strategic diversification will remain the foundation of investor resilience.

Educational purposes only, not financial advice.

1 thought on “Global Debt 2025: $315 Trillion Threatens Stability”