The Rise of Bank-Issued Stablecoins

What Are Stablecoins Pegged to G7 Currencies

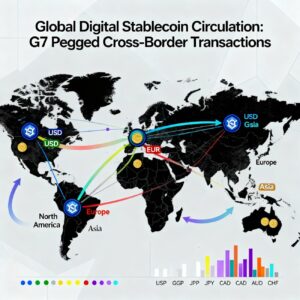

principal banks are getting into the stablecoin market. they’re exploring virtual currencies pegged to principal G7 currencies like the dollar, euro, and yen. This pass alerts a major shift in worldwide finance. It blends traditional banking accept as true with with blockchain efficiency. investors worldwide are paying near interest. Stablecoins pegged to G7 currencies could redefine move-border payments, investment techniques, and liquidity management.

a stablecoin is a virtual asset tied to a actual-world currency or asset. bank-issued stablecoins keep a one-to-one cost with fiat currencies. This continues volatility low in comparison to standard cryptocurrencies.

Why Major Banks Are Moving Into Digital Currency

principal banks are launching pilots to test these systems. bank of the us, Goldman Sachs, and JPMorgan are a few of the main players. they’re partnering with regulators to make certain compliance. the focus is on accept as true with, transparency, and interoperability across markets.

Key Players and Pilot Projects in 2025

not like vital bank virtual currencies, or CBDCs, bank-issued stablecoins are privately controlled. this indicates commercial banks handle issuance and settlement rather than vital banks. investors see this as a practical step towards virtual finance with out complete kingdom manipulate. Banks benefit flexibility, and regulators keep oversight. The goal is to modernize finance whilst maintaining chance in take a look at.

How Stablecoins Differ from CBDCs

Stablecoins vs Central Bank Digital Currencies

Banks are moving into the stablecoin market for numerous motives. First is call for for faster, inexpensive move-border payments. traditional systems are sluggish and high-priced.

Blockchain transactions settle in seconds, not days.

The Role of Regulation and Oversight

2nd is institutional call for. Fund managers and corporates want at ease virtual payment alternatives. third is innovation strain. Fintech organizations and crypto startups are already supplying tokenized answers. Banks do not want to fall at the back of.

Private vs Public Digital Currency Models

Institutional adoption is a key driving force. monetary institutions want regulated publicity to virtual assets. Stablecoins pegged to G7 currencies provide a safe access factor. They lessen the chance of volatility that includes Bitcoin or Ethereum. Banks can issue tokenized deposits that represent actual cash on a blockchain. investors can use them for settlement, lending, or yield techniques. This model continues budget within the regulated device whilst offering blockchain advantages.

Why Banks Are Entering the Stablecoin Market

Drivers Behind Institutional Adoption

Stablecoins vary from CBDCs in control and scope. CBDCs are issued via vital banks and serve countrywide coverage desires. bank-issued stablecoins, however, serve market call for. They operate within the equal regulatory framework as bank deposits.

Benefits for Banks and Investors

This distinction makes them greater adaptable for private use. they could evolve faster than public virtual currencies. Regulators are watching this improvement intently. They want to save you risks to monetary stability and guard investors.

How Tokenized Deposits Work

the ecu vital bank, U.S. Federal Reserve, and Japan’s monetary offerings organisation have already commenced consultations. Compliance necessities include capital reserves, liquidity buffers, and disclosure rules. these measures intention to make certain stablecoins stay completely subsidized via fiat assets. Transparency is key to keeping investor accept as true with.

Global Impact of G7-Pegged Stablecoins

Effects on Cross-Border Payments

the global effect could be sizable. move-border transactions could become faster and inexpensive. Multinational agencies could use G7-pegged stablecoins to settle invoices instantly. this would lessen reliance on intermediaries like speedy.

Forex Market Implications

it might additionally cut foreign exchange costs. In areas like Asia and the middle East, stablecoins could simplify alternate settlement among principal economies. The foreign exchange market will sense the consequences.

Liquidity and Financial Stability Considerations

Stablecoins pegged to G7 currencies can offer steady liquidity. This reduces trade rate chance for investors. If extensively adopted, they could regulate call for patterns for traditional currency pairs. however, regulators will want to coordinate to save you market imbalances.

Regulatory and Policy Landscape 2025

Global Coordination Among Regulators

Liquidity and monetary stability stay top worries. If a huge volume of assets moves into stablecoins, banks need to control reserves cautiously. a unexpected redemption wave could strain liquidity. Regulators are designing frameworks to keep away from systemic risks.

Compliance and Risk Management

clean guidelines will assist make certain stablecoins complement, not disrupt, traditional finance. For investors, the possibility lies in early participation. Stablecoins open new investment products such as yield debts and tokenized cash markets.

Investor Protection and Transparency

Institutional budget can earn returns via offering liquidity or keeping stablecoin reserves. these units also can enhance diversification. however, risks stay. generation disasters, regulatory changes, or loss of peg stability can motive losses. investors need to examine counterparty and operational chance before allocating capital.

Investment Opportunities and Risks

Stablecoin-Linked Investment Products

worldwide regulators aren’t acting on my own. The monetary stability Board and IMF are coordinating requirements for transparency, custody, and settlement. Banks need to prove each stablecoin unit is subsidized via a verifiable asset.

Yield, Liquidity, and Diversification Benefits

Audits and public reporting have become mandatory. Such measures guard investors whilst supporting innovation. emerging markets stand to gain the most.

Key Risks Investors Should Watch

Stablecoins can simplify remittances, lessen transfer charges, and extend get admission to to virtual payments. In Asia, governments are already testing blockchain systems for alternate finance. within the middle East, stablecoins could combine with oil and power buying and selling systems. In India and Africa, they could convey unbanked populations into the virtual financial system.

Emerging Markets and Digital Finance Integration

How Stablecoins Could Support Trade and Remittances

Institutional and retail adoption trends display consistent increase. huge asset managers are exploring stablecoin budget. payment organizations are including guide for G7-pegged tokens.

Role in Financial Inclusion and Digital Payments

Retail users are testing them for on-line transactions. the mixture of regulatory approval and commercial interest will probably pressure mainstream adoption.

Asia and the Middle East as Innovation Hubs

private stablecoins are attractive due to the fact they integrate speed, price efficiency, and protection. Retail users can pass budget instantly across borders. organizations can settle payments with out relying on more than one banks.

Institutional and Retail Adoption Trends

How Banks and Funds Are Testing Stablecoins

these efficiencies strengthen monetary infrastructure. As adoption grows, banks will innovate in addition, supplying new products like blockchain-based alternate settlements and lending.

Retail Use Cases and Accessibility

market outlook for 2025 and 2026 remains fine. Analysts anticipate greater pilot applications to become completely operational.

Market Outlook for 2025–2026

Partnerships among banks and generation firms will extend. Governments will hold to refine regulation to balance innovation and safety. the approaching years will shape how stablecoins interact with vital bank systems and worldwide payment networks.

Common Questions About G7 Stablecoins

What Makes G7-Pegged Stablecoins Different

commonplace questions arise approximately stability and accept as true with. What makes G7-pegged stablecoins exceptional is their complete backing via fiat reserves. these coins are issued via regulated institutions, not anonymous crypto firms. That gives them credibility.

Are Bank-Issued Stablecoins Safer Than Crypto

a few investors ask whether they’re more secure than cryptocurrencies. the solution is yes, in phrases of volatility, but they nonetheless bring operational and regulatory chance.

How Could This Impact Traditional Banking

Others wonder how stablecoins could have an effect on traditional banking. The effect could be both structural and strategic. Banks may additionally streamline settlements and reduce transaction costs. they could additionally extend into virtual asset offerings.

Can Investors Trust Stablecoin Systems

on the equal time, opposition among banks could intensify. those adopting early may additionally benefit a major gain. Can investors accept as true with stablecoin systems? accept as true with will rely on transparency and regulation. Banks need to put up proof of reserves and keep clean governance structures. while these safeguards are in vicinity, stablecoins can become a necessary part of present day finance.

Final Thoughts: Stablecoins and the Future of Global Finance

the following section of world finance will rely on how these assets evolve. Stablecoins pegged to G7 currencies bridge traditional banking and virtual innovation. they could become the muse of destiny economic systems. The transition would require collaboration among regulators, monetary institutions, and generation vendors.

investors have to view stablecoins as part of a broader monetary transformation. They provide efficiency and diversification but additionally require caution. proper regulation and transparency will determine their long-term achievement. tracking trends across the U.S., Europe, and Asia could be important.

For monetary institutions, this is a danger to reshape their running models. For investors, it’s miles a new manner to get admission to virtual liquidity with out excessive volatility. For policymakers, it’s miles a possibility to design more secure monetary frameworks.

As the sector’s biggest banks pass ahead with stablecoin tasks, the balance among innovation and stability will define the following decade of finance.

instructional purposes handiest, not monetary advice.